Introduction to HIBT Price Trends

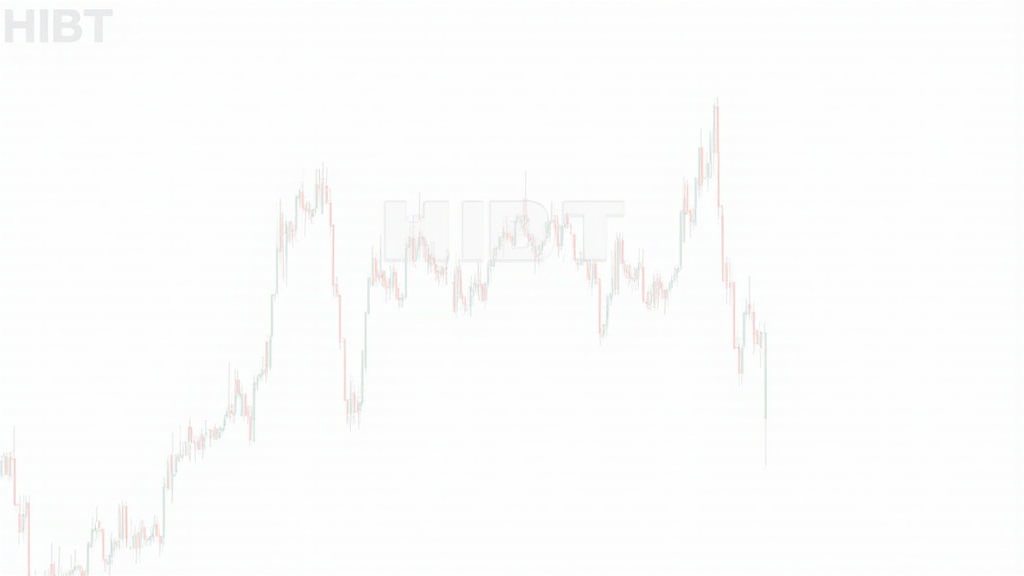

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges are currently vulnerable. This raises concerns for investors interested in HIBT, especially as we navigate a market increasingly focused on cross-chain interoperability and zero-knowledge proof applications. In this article, we will delve into HIBT price technical analysis to help you understand the current market environment.

Understanding Technical Analysis: A Quick Breakdown

When we talk about technical analysis, think of it like trying to guess the price of a ripe avocado at your local market. Traders look at past prices, volume, and patterns to predict future movements. For HIBT, you might find certain price patterns similar to how specific fruits seasonally vary in price.

Key Indicators for HIBT Investment

One might wonder what indicators can help gauge the future of HIBT. Just like when shopping for the best fruits, traders often look at the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI). These are essential tools that help identify potential buy or sell moments by comparing current prices to historical trends.

What Does the Future Hold for HIBT?

As we look toward 2025, it’s crucial to watch for developments in DeFi regulation in Singapore and how they’ll impact HIBT. Like adjusting to new store hours during holidays, investors must be aware of regulatory changes that could influence price orientation. Insights from CoinGecko 2025 show that DeFi, including HIBT, has potential for substantial growth amidst regulatory clarity.

Conclusion: The Future of HIBT Price

In conclusion, the technical analysis of HIBT reveals key factors that may impact its price in the coming years. By understanding cross-chain interoperability and the significance of zero-knowledge proofs, investors can make informed decisions. Don’t forget to download our comprehensive toolkit to help you dive deeper into HIBT analysis and investment strategies!