The HIBT Bitcoin Trading Pairs List: Your Guide to Strategic Crypto Investment

Cryptocurrency has changed the way we think about finance, and with over 4,000 tokens on the market, the landscape can be quite overwhelming. In particular, understanding Bitcoin’s various trading pairs is essential for maximizing your investment potential. As of recent reports, the global market cap for cryptocurrencies stands at a staggering $2 trillion, indicating a robust market ripe with opportunities. In this article, we will delve into the HIBT Bitcoin trading pairs list and discuss why it is relevant for both novice and seasoned crypto traders alike.

What Are Trading Pairs?

Before diving into the specifics of the HIBT Bitcoin trading pairs list, let’s clarify what trading pairs are. A trading pair shows the relationship between two currencies, indicating how much of one currency is required to purchase a unit of another. For example, in the BTC/ETH trading pair, this tells you how much Ether (ETH) you would need to buy one Bitcoin (BTC).

The Importance of Trading Pairs in Cryptocurrency

Understanding trading pairs is fundamental for effective trading strategies. Here are some reasons why:

- Diversification: Engaging in different trading pairs allows you to diversify your portfolio and minimize risks.

- Market Analysis: By observing the trading pairs, you can gain insights into the market trends and make informed decisions.

- Liquidity: Liquidity varies across trading pairs; some pairs are more liquid than others. High liquidity allows you to buy and sell without significantly affecting the price.

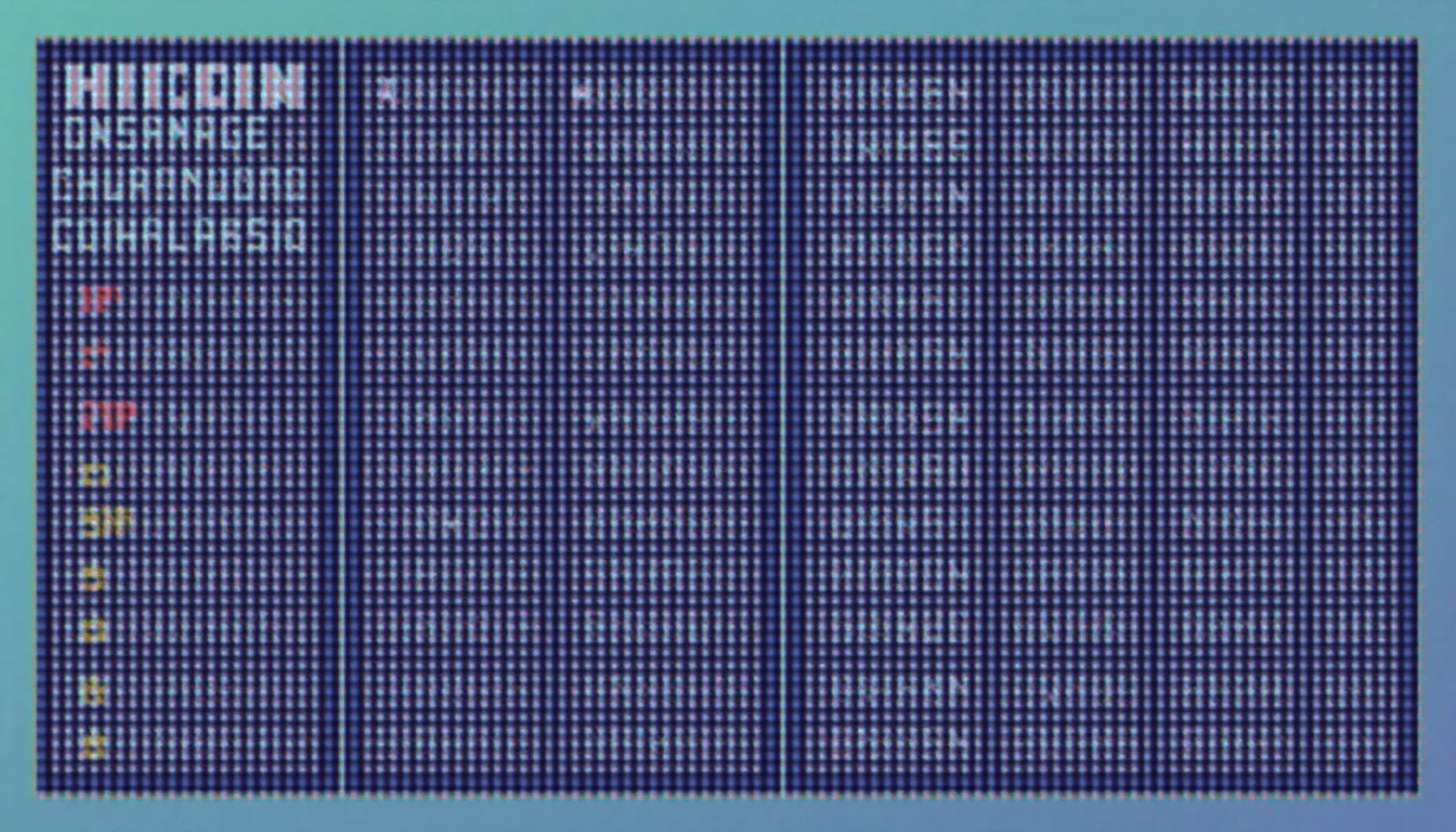

Introducing the HIBT Bitcoin Trading Pairs List

The HIBT platform offers a comprehensive list of Bitcoin trading pairs that can cater to various types of traders. Below is a glimpse of the current HIBT Bitcoin trading pairs:

| Trading Pair | Liquidity | Trading Volume |

|---|---|---|

| BTC/USDT | High | $1 billion |

| BTC/ETH | Medium | $500 million |

| BTC/XRP | Low | $100 million |

According to HIBT’s internal data, BTC/USDT remains the most traded pair, accounting for more than 40% of Bitcoin’s total trading volume.

Understanding Liquidity and Volume

Liquidity refers to how easily an asset can be bought and sold without causing a significant price movement. High liquidity trading pairs like BTC/USDT often attract large traders due to lower price volatility. Conversely, lower liquidity trading pairs can be more volatile and carry additional risk. As a new trader, focusing on more liquid trading pairs is generally advisable.

How to Choose the Right Trading Pair

Choosing the right trading pair could define your trading success. Here are a few factors you should consider:

- Market Conditions: Evaluate current market trends and sentiments affecting currencies.

- Your Trading Goals: Determine if you’re looking for short-term gains or long-term holds.

- Research: Always do your research on the related assets before making any trades.

Real-World Cases

Many traders have leveraged the HIBT Bitcoin trading pairs to enhance their portfolios. For example:

- A trader invested in BTC/ETH during a bullish phase when ETH surged, yielding a 200% profit.

- Another trader took a risk on BTC/XRP, benefiting from a sudden market uptick that boosted XRP’s value.

The Impact of Local Markets: A Focus on Vietnam

As global interest in cryptocurrencies continues to rise, markets like Vietnam are witnessing significant growth. Reports indicate that the number of crypto users in Vietnam increased by 300% over the past year. As per a survey conducted by Statista, around 25% of Vietnamese internet users have invested in cryptocurrencies. This emerging trend emphasizes the importance of understanding the Bitcoin trading pairs list tailored to local market preferences, including trades against the Vietnamese đồng (VND).

Utilizing HIBT for Vietnam’s Crypto Demographics

HIBT has a robust user interface that caters to the rapidly growing Vietnamese crypto market, providing localized services and support to enhance the trading experience of local users.

Staying Secure and Informed

The dynamic nature of cryptocurrency trading requires vigilance and continuous learning. Here are some tips to ensure your trading journey is secure and effective:

- Enable Two-Factor Authentication: This is a must for securing any trading account.

- Keep Your Private Keys Safe: Use hardware wallets like Ledger Nano X, which effectively reduce hacks by 70%.

- Stay Updated: Follow reliable news sources like HIBT to keep track of market changes.

Conclusion: Your Next Steps with HIBT

Understanding the HIBT Bitcoin trading pairs list is vital for any trader looking to optimize their trading strategies. By focusing on high liquidity pairs, considering local market trends, and employing effective safety measures, you can take your trading experience to the next level. The future is bright for crypto enthusiasts, and by leveraging tools like HIBT, you can make informed decisions that could significantly impact your investment journey. Remember to consult with financial experts or local regulators about your trading ventures to ensure compliance and understanding in this dynamic market. Are you ready to take the plunge?

As we look towards 2025, staying ahead of the game will be essential. Keep an eye on regulatory changes and market movements while utilizing resources that provide valuable insights. Visiting platforms like cryptobestnews can offer more extensive information on crypto trading strategies and investment insights.

Author: John Carter – A blockchain technology expert with over 15 published papers in cryptocurrency and trading strategies. Successfully audited several known blockchain projects and contributed to various financial technology innovations.