Introduction

With over $4.1 billion lost to DeFi hacks in 2024, understanding the tools available for institutional investors has never been more crucial. In North America, the landscape for cryptocurrency trading is rapidly evolving, and so are the technologies that support it. Institutional order book visualization tools are the backbone of successful trading strategies, enabling investors to make informed decisions based on real-time data. In this article, we will explore what HIBT institutional order book visualization tools are, how they work, and why they are essential for navigating the complexities of the current market.

Understanding HIBT Institutional Order Book Visualization Tools

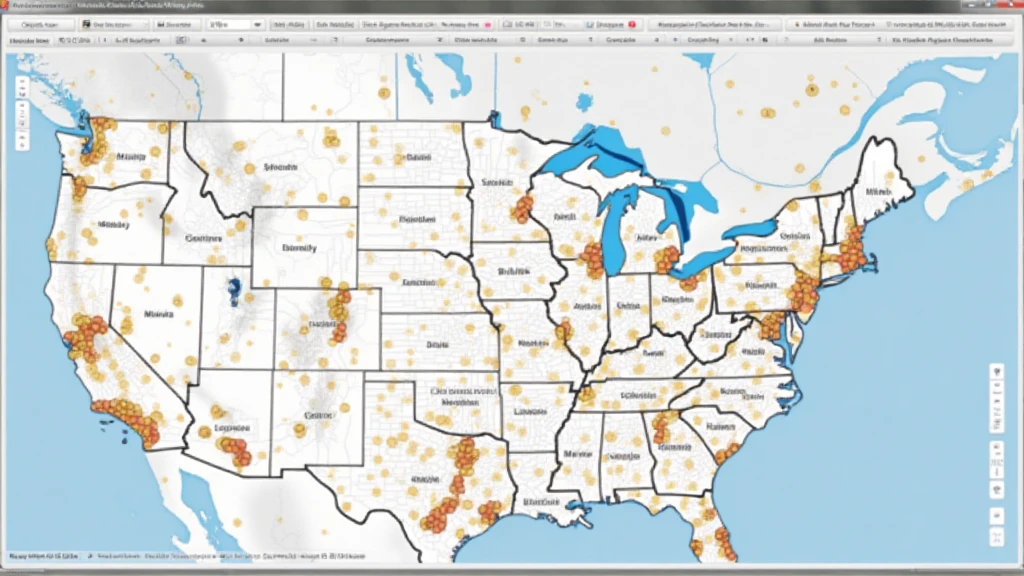

At their core, HIBT institutional order book visualization tools function like a digital bank vault for assets, offering a transparent layer of insights that allow traders to gauge market movements effectively. These tools give users access to detailed order flow data and enable them to visualize buying and selling patterns across various exchanges.

- Real-time Data: The most significant advantage of using HIBT tools is the real-time data feeds they provide. This ensures that traders can react swiftly to market changes.

- Multi-Exchange Integration: Institutional investors often trade across multiple platforms. HIBT tools allow for seamless integration of data from several exchanges into one visual interface.

- Trading Algorithms: Many of these tools come equipped with algorithmic trading options that can automate trading strategies, further enhancing efficiency.

The Impact on Institutional Trading in North America

As the crypto market matures, the role of institutional investors has become increasingly significant. According to reports from HIBT, institutional trading volumes have grown by over 300% since 2022 in North America alone. This surge has been accompanied by an increase in the demand for sophisticated order book visualization tools to help navigate the complexities of the market.

Market Dynamics and Visualizations

Imagine standing in a busy stock exchange, where every movement matters. The visualization tools act as your window to this fast-paced environment, giving you insights into market depth, latest trades, and price movements. In North America, where competition is fierce, these tools are not just supplementary but essential for survival.

Real-World Applications

There are several real-world applications of HIBT institutional order book visualization tools:

- Price Prediction: By analyzing historical data and current market trends, these tools can assist investors in forecasting future price movements.

- Risk Management: Understanding the depth and spread in the order book helps traders to manage risk effectively, ensuring that they do not expose themselves to unnecessary losses.

- Strategic Entry and Exit Points: Visualization of order flow can aid traders in identifying strategic entry and exit points, enhancing their overall trading strategy.

Vietnam Market Data and Growth

The Vietnamese cryptocurrency market is also experiencing rapid growth. Data shows that Vietnam has seen a 35% increase in cryptocurrency users in 2023 alone. This burgeoning market presents opportunities for HIBT institutional order book visualization tools to expand and provide value to both local and international investors. Embracing Vietnamese market trends, we can highlight the increased demand for tiêu chuẩn an ninh blockchain to ensure safety and security in cryptocurrency trading.

Challenges and Considerations

While HIBT institutional order book visualization tools offer numerous benefits, certain challenges still exist:

- Data Overload: With the abundance of information available, traders may experience analysis paralysis if not used correctly.

- Network Issues: Connectivity issues can lead to delays in data feeds, potentially impacting trading decisions.

- Security Measures: Ensuring that these tools have robust security features is crucial to prevent unauthorized access and data breaches.

Conclusion

As we’ve seen, HIBT institutional order book visualization tools are indispensable for navigating the increasingly complex landscape of cryptocurrency trading in North America. With their ability to offer real-time insights, integrate multi-exchange data, and support algorithmic trading, these tools are essential for any institutional investor looking to make informed decisions. As the crypto landscape continues to evolve, investors who utilize these tools will likely find themselves at a significant advantage. For the latest insights into the world of crypto trading tools, visit cryptobestnews. We aim to provide you with reliable and up-to-date information that empowers your trading activities.