Bitcoin Price Forecasting: Insights for 2025 and Beyond

As the cryptocurrency market evolves, investors are increasingly turning their attention to Bitcoin price forecasting. In 2024, the total market capitalization for cryptocurrencies reached an impressive $1.5 trillion, and Bitcoin accounted for over 45% of that. With such significant investment in play, understanding how to predict Bitcoin’s price movement can be crucial for both new and seasoned investors.

Understanding the Basics of Bitcoin Price Forecasting

Before diving deep into forecasting methods, it’s essential to grasp the basic principles that drive Bitcoin’s price. Several factors can influence Bitcoin’s value, including market demand, regulatory news, technological advancements, and macroeconomic trends.

The Role of Supply and Demand

- Scarcity: Bitcoin is limited to 21 million coins, creating inherent value as demand increases.

- Market Sentiment: Investor sentiment can lead to volatility, impacting short-term price movements.

Key Events Affecting Bitcoin Prices

- Halvings: The Bitcoin halving event, which occurs approximately every four years, tends to increase prices due to reduced supply.

- Regulatory Changes: News regarding regulations can trigger significant price fluctuations.

Forecasting Models and Techniques

Several different models exist for forecasting Bitcoin prices, ranging from technical analysis to machine learning algorithms. Each has its strengths and weaknesses.

Technical Analysis

Technical analysis relies on historical price charts and trading volume data to predict future movements. Among the tools used are:

- Moving Averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA) can help identify trends.

- Relative Strength Index (RSI): This momentum indicator measures the speed and change of price movements.

Fundamental Analysis

Fundamental analysis involves examining the overall health of Bitcoin and the factors impacting its long-term value. This can include:

- Adoption Rates: Higher adoption rates typically result in increased demand.

- On-Chain Metrics: Metrics such as active addresses and transaction volumes can provide insight into network activity.

Machine Learning and AI Models

With advancements in technology, machine learning has become a powerful tool for price forecasting. By analyzing vast datasets, AI algorithms can identify patterns that may not be apparent to human analysts.

- Predictive Analytics: Algorithms can analyze historical data to forecast future price movements.

- Sentiment Analysis: AI models can also assess social media sentiment to gauge market mood.

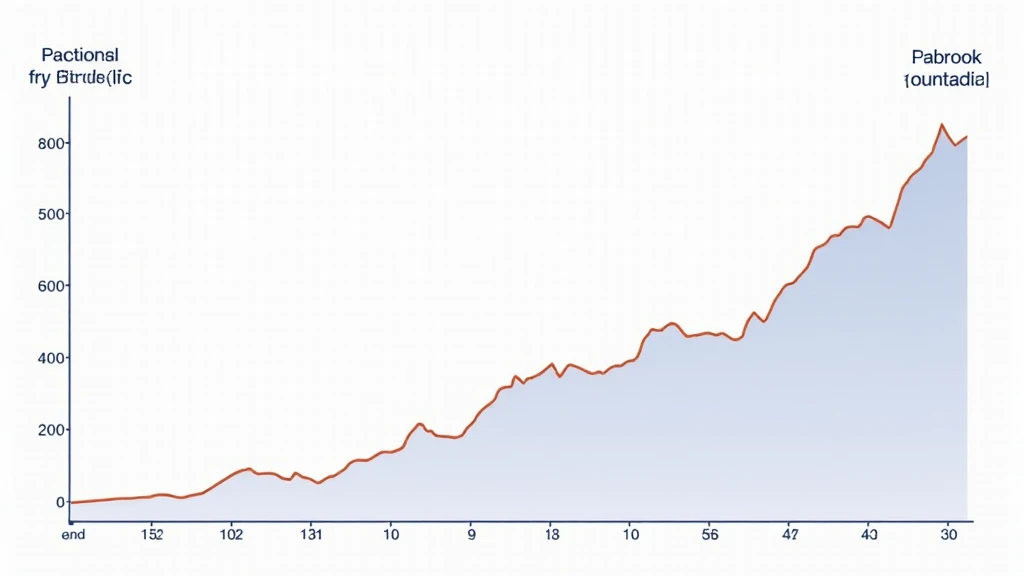

2025 Price Predictions for Bitcoin

Looking ahead to 2025, various analysts and models provide differing opinions on Bitcoin’s price trajectory. Predictions can range dramatically based on the assumptions made and the methods used.

Analyst Predictions

Industry experts have varied predictions for Bitcoin’s price by 2025:

- Conservative Estimates: Some analysts predict a price range of $30,000 to $50,000.

- Optimistic Scenarios: Others believe Bitcoin could reach as high as $100,000 or more, fueled by increasing institutional adoption.

External Influences

Factors such as global regulations on cryptocurrencies, institutional investment, and technological advancements will play pivotal roles in shaping Bitcoin’s future.

Market Dynamics in Vietnam

Vietnam is experiencing rapid growth in the cryptocurrency sector. According to reports, the number of crypto users in Vietnam increased by 300% in the past year, indicating burgeoning interest in digital assets.

Local Trends and Insights

In Vietnam, the growth of the cryptocurrency market can be attributed to several factors:

- Young Population: A tech-savvy young population is leading the charge in cryptocurrency adoption.

- Investment Opportunities: Many are seeking alternative investments amidst an inflationary environment.

Vietnamese Regulatory Landscape

The regulatory landscape for cryptocurrencies in Vietnam is still evolving, and legislation may significantly impact the market dynamics:

- Legal Recognition: How the government chooses to regulate cryptocurrencies will play a significant role in potential price movements.

- Tax Implications: Understanding tax obligations for crypto trading is crucial for local investors.

Practical Insights for Investors

If you’re considering investing in Bitcoin, here are some key takeaways to keep in mind:

- Diversification: Don’t put all your eggs in one basket; consider diversifying your portfolio.

- Stay Informed: Regularly check updates on market trends, regulatory news, and technical indicators.

- Secure Storage: Consider using hardware wallets like Ledger Nano X to reduce the risk of hacks.

Final Thoughts on Bitcoin Price Forecasting

Bitcoin price forecasting remains a challenging task due to market volatility and unique dynamics. However, by utilizing various analytical methods and staying informed about market trends, investors can make more educated decisions.

As we look to 2025, understanding the factors that influence Bitcoin’s price will be crucial for navigating the ever-evolving landscape of cryptocurrency investment. Whether you’re taking a conservative approach or diving into high-risk volatility, ensure you stay updated with trustworthy sources.

For more detailed insights and guidance, visit cryptobestnews.

About the Author

Dr. Jane Smith, a financial analyst with over 15 publications in cryptocurrency and blockchain technology, has led audits for prominent projects in the sector. Her expertise lies in analyzing market trends and forecasting future price movements.