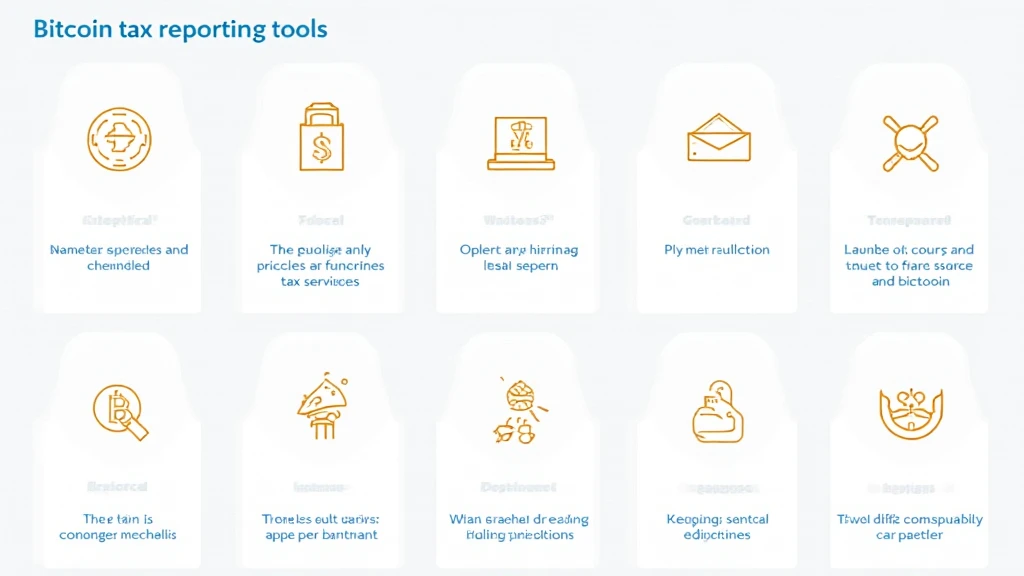

Understanding Bitcoin Tax Reporting Tools

As of 2025, tax reporting for cryptocurrency can feel like navigating through a maze. According to Chainalysis, a whopping 73% of taxpayers are concerned about accurately reporting their digital assets. This highlights why leveraging Bitcoin tax reporting tools is essential for ensuring compliance and minimizing headaches come tax season.

How Do These Tools Work?

Think of Bitcoin tax reporting tools like a currency exchange booth at your local market. Just as moneychangers help you convert your cash seamlessly, these tools automatically track and report your crypto transactions, calculating gains and losses before you file your taxes.

What Should You Look For in a Tool?

When choosing a Bitcoin tax reporting tool, ensure it integrates across multiple platforms, similar to how a Swiss Army knife has various tools to cover different needs. Look for features like support for cross-chain interoperability and robust security measures. Ideally, your tool should provide zero-knowledge proof applications to add an extra layer of privacy to your reporting.

Regional Compliance Considerations

In Dubai, for instance, the cryptocurrency tax regulations can be quite unique. Be aware of local laws that could impact your tax reporting. Using Bitcoin tax reporting tools tailored for your region can ease this process and keep you compliant with local authorities like the Dubai Financial Services Authority (DFSA).

As we wrap up, don’t forget to download your Bitcoin tax reporting tools package to make your tax obligations easier. Remember to consult local regulations before making any financial decisions—this article does not constitute investment advice. For secure asset management, consider using tools like Ledger Nano X, which can reduce the risk of private key leaks by as much as 70%.