Understanding Coinbase Crypto Stablecoin Liquidity Pools

According to Chainalysis data from 2025, a staggering 73% of current liquidity pools lack the necessary security measures, which raises the risk factor for potential investors. As we delve into Coinbase’s strategy with its crypto stablecoin liquidity pools, we’ll highlight essential features to understand how they could redefine the landscape of decentralized finance (DeFi).

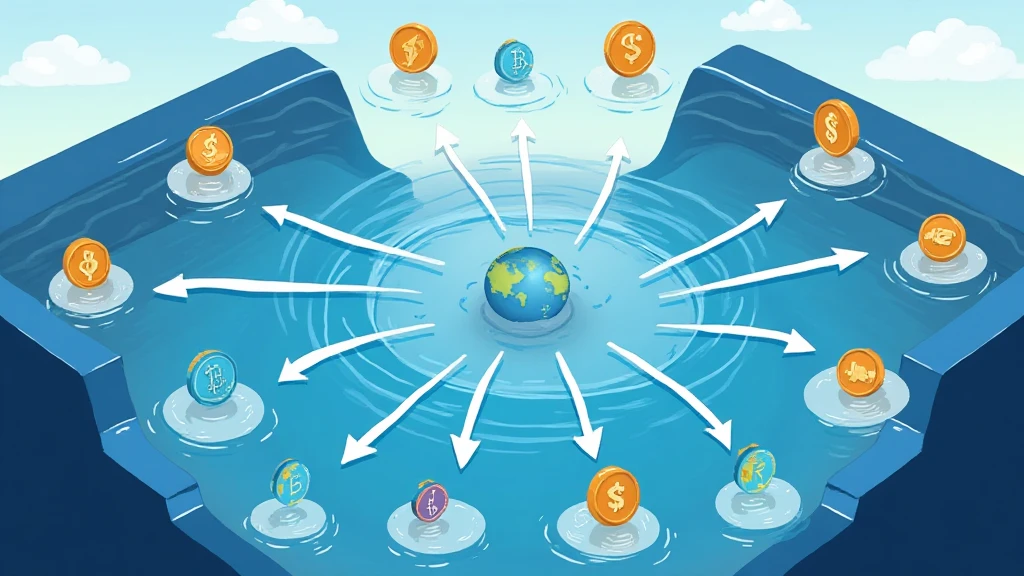

What Are Liquidity Pools?

Think of liquidity pools like a communal fish tank in a market. Each trader adds their ‘fish’ (capital) so that others can come and trade without any waiting time for fresh supply. In the context of Coinbase, stablecoin liquidity pools provide an essential service by ensuring trades are executed efficiently without price slippage.

How Does Coinbase Enhance Stability?

Coinbase’s liquidity pools include a mix of stablecoins, which minimizes volatility. It’s like having a basket of apples instead of just one type. If one apple is bruised (devalues), the others maintain the overall value of the basket. This strategy is particularly beneficial as market appetite for stablecoin liquidity continues to grow.

Cross-Chain Interoperability: The Future of Liquidity

You might have heard about how cross-chain operability can impact trade efficiency. Think of it as a universal remote control for multiple TVs (blockchains). Coinbase’s approach allows these liquidity pools to interact seamlessly with various platforms, unlocking greater trading capabilities.

Potential Risks and Security Measures

While liquidity pools offer exciting opportunities, you might be wondering about the risks involved. The analogy of a market stall applies here again: just as an unattended stall can invite theft, a poorly secured liquidity pool can attract bad actors. Coinbase’s implementation of zero-knowledge proofs aims to enhance security by ensuring transactions are valid without revealing sensitive data.

In conclusion, Coinbase’s innovations around crypto stablecoin liquidity pools promise a more resilient, efficient environment for traders, making it a notable player in the evolving DeFi space. For further insights, be sure to download our comprehensive tool kit that includes essential guides on secure trading practices and more.

Check our liquidity pool security guide here!

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authority before taking any trading actions.

For enhanced security, consider using Ledger Nano X to reduce private key exposure risks by up to 70%.