Cryptocurrency Bond Collateral Optimization: A Comprehensive Guide

According to 2025 data from Chainalysis, a staggering 73% of cryptocurrency bonds face collateral inefficiencies. This poses significant risks in a market that is increasingly relying on decentralized finance (DeFi) solutions. Addressing these concerns, cryptocurrency bond collateral optimization emerges as a critical subject.

What is Cryptocurrency Bond Collateral Optimization?

Think of cryptocurrency bond collateral optimization like a farmer ensuring the right amount of seeds is planted to maximize crop yield. Just as farmers analyze soil and weather conditions, investors must assess market dynamics and liquidity to secure better returns. In essence, this optimization combines technical strategies and market insights to fortify investments.

How Does Cross-Chain Interoperability Play a Role?

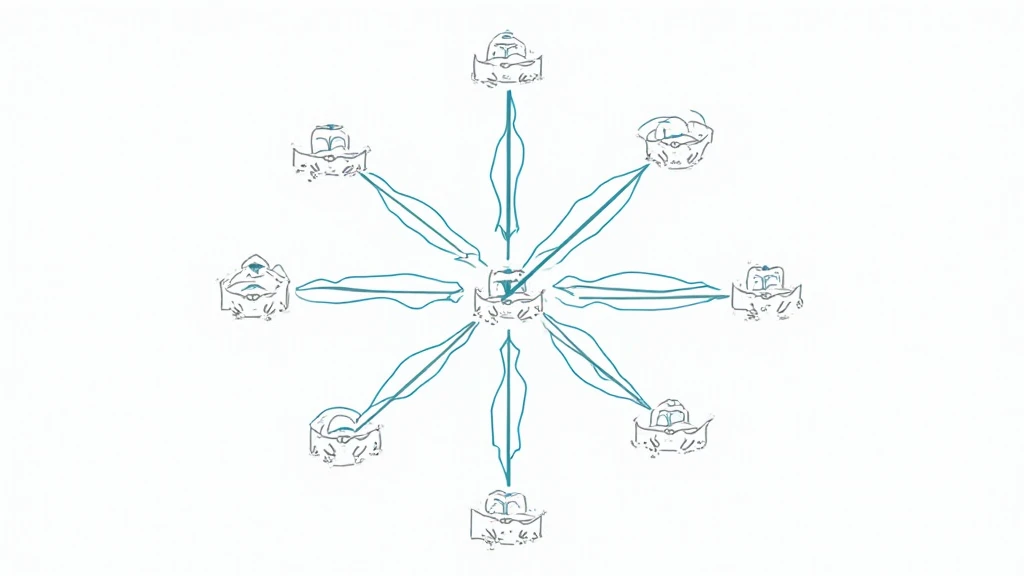

Imagine you want to exchange currency while traveling. You visit a currency exchange booth that accepts various currencies. Similarly, cross-chain interoperability allows different blockchain networks to communicate, enhancing collateral effectiveness. By leveraging this technology, the collateral across various platforms can be optimized, leading to more robust financial products.

The Impact of Zero-Knowledge Proofs

Zero-knowledge proofs (ZKPs) can be likened to a magical seal that proves you have something valuable without revealing what it is. These cryptographic protocols enhance trust in transactions, providing security while optimizing collateral arrangements. By utilizing ZKPs, users can ensure that their collateral remains secure and private in the volatile cryptocurrency market.

What is the Future of DeFi Regulations?

As we approach 2025, it’s crucial to consider the regulatory landscape shaping cryptocurrency bond collateral optimization. For instance, Singapore is expected to introduce comprehensive DeFi regulations that will significantly impact how collateral is managed and utilized in the DeFi sphere. Staying updated with these regulations is key for investors looking to navigate this evolving environment.

In conclusion, cryptocurrency bond collateral optimization is essential for investors to mitigate risks and enhance returns across decentralized finance platforms. Understanding key concepts like cross-chain interoperability and zero-knowledge proofs can empower investors. For deeper insights into this subject and tools to help optimize your investments, download our comprehensive toolkit.

Meta Description: Discover how cryptocurrency bond collateral optimization can enhance your investment strategy and mitigate risks in the financial market.

For more information, check out our other resources at hibt.com. Don’t miss our cross-chain security white paper and expert insights.

Disclaimer

This article does not constitute financial advice. Always consult with local regulatory agencies such as MAS or SEC before making investment decisions. For enhanced security, consider using Ledger Nano X to reduce private key exposure risks by 70%.

Article by Dr. Elena Thorne,

Former IMF Blockchain Advisor | ISO/TC 307 Standard Setter | Author of 17 IEEE Blockchain Papers