Introduction

Have you ever wondered how $4.1 billion was lost to DeFi hacks in 2024? As digital assets like cryptocurrencies gain momentum, understanding their valuation becomes paramount. This article will explore various cryptocurrency property valuation methods, delivering insights crucial for investors, appraisers, and market analysts alike. Through this journey, we shall discuss the essential approaches in grasping the worth of these dynamic assets.

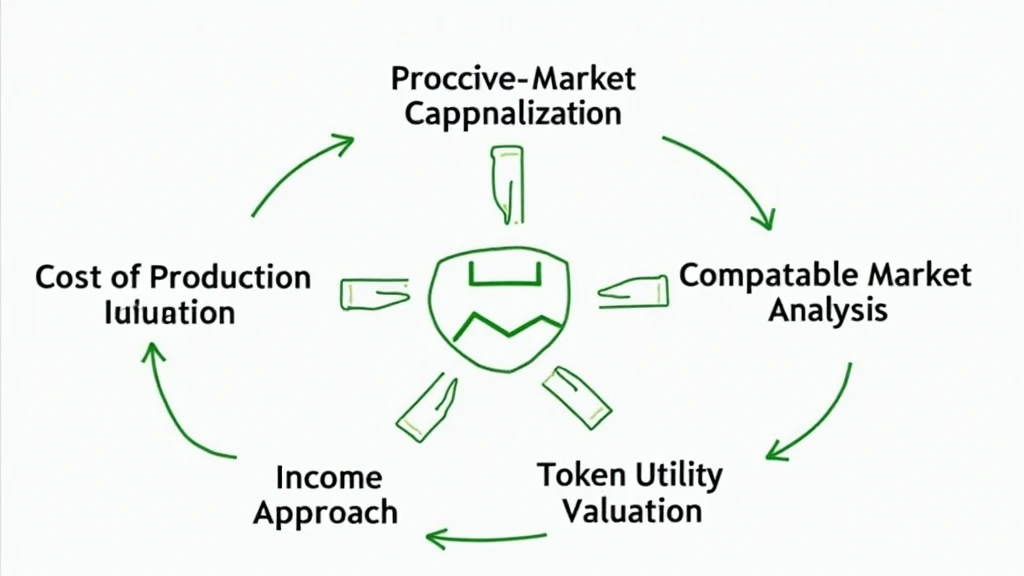

Understanding Cryptocurrency Valuation

At its core, cryptocurrency valuation involves the process of establishing the worth of digital assets, influenced by factors like market demand, utility, liquidity, and technological aspects. Like traditional property valuation, these methods seek to quantify an asset’s price in a competitive marketplace.

1. Market Capitalization Method

One of the most straightforward methods to value cryptocurrencies is through market capitalization:

- Market Cap = Price per Coin x Total Supply

Let’s break it down further: the market capitalization reflects a cryptocurrency’s total dollar value in circulation. Market sentiment heavily influences this approach. Bitcoin, for instance, currently holds a market cap of approximately $700 billion, a testament to its widespread acceptance and adoption.

2. Cost of Production Method

The cost of production method focuses on the expenses required to generate the cryptocurrency:

- Electricity costs

- Mining hardware expenses

- Maintenance fees

This method is especially relevant for proof-of-work coins, such as Bitcoin, where mining costs fluctuate based on energy prices and hardware efficiency.

3. Income Approach

Analogous to how real estate is assessed, this method evaluates potential earnings from the asset:

- Transaction fees

- Staking rewards

- Network fees

Determining the net income can provide an estimate of the cryptocurrency’s value. This method emphasizes future cash flows and is critically dependent on project viability.

4. Comparable Market Analysis (CMA)

Just like property appraisers use CMA in real estate markets, this method involves comparing similar cryptocurrencies:

- Analyze features

- Review trade volumes

- Assess technology

For example, by comparing Ethereum with other smart contract platforms, one can discern potential value discrepancies.

5. Token Utility Valuation

It’s essential to evaluate the actual utility of a token within its ecosystem. Considerations might include:

- Usage in decentralized finance (DeFi)

- Governance participation

- Access to specific services

This approach assesses the demand for a token as functional currency within a protocol, linking its intrinsic value tied to actual utility.

The Role of Technology in Valuation

The valuation of cryptocurrencies also adjusts to emerging technologies like Artificial Intelligence and Machine Learning. Tools utilize algorithms to analyze price trends and market sentiment:

- Predictive analytics

- Sentiment analysis from social media

- Market trend mappings

As blockchain technology evolves, many platforms provide automated valuations, enhancing the speed and accuracy with which market players can transact.

Valuation Methods Impact in Vietnam

In Vietnam, the cryptocurrency market has seen a tremendous growth rate of over 200% in 2022. This explosion highlights the urgency of establishing reliable cryptocurrency property valuation methods. Vietnamese investors and traders are increasingly leveraging various valuation approaches to ensure a perceived value aligns with reality and combats volatility.

Key Insights into Vietnamese Market

- The Vietnamese government encourages blockchain development.

- Increased interest in NFT and DeFi projects.

- Regulatory frameworks are being formed for better investor protection.

The importance of clear and effective valuation methods cannot be overstated in this growing space.

Challenges in Cryptocurrency Valuation

Valuing cryptocurrencies is not without its challenges. Several complexities can arise, such as:

- Volatility of the cryptocurrency market

- Lack of standardized valuation practices

- Limited historical data for many altcoins

Investors should approach valuations with a critical eye, accounting for these challenges to mitigate risks associated with their investments.

Conclusion

In summary, cryptocurrency property valuation methods are essential for investors seeking insight into their digital assets. Market capitalization, cost of production, income approach, comparable market analysis, and token utility valuation each provide unique insights into asset worth. As the cryptocurrency landscape continues to evolve, new valuation techniques will likely emerge, reinforcing the need for investors to remain well-versed. For those involved in the burgeoning Vietnamese market, understanding these methods will prove crucial for future success and stability. Always remember, it is essential to research thoroughly and consult local regulations to secure your investments. Trust the process and keep exploring the landscape to unlock your asset’s true potential.

For more insights on cryptocurrency and blockchain, visit cryptobestnews. Stay informed about the latest trends, regulations, and emerging technologies in the digital asset space.