Introduction

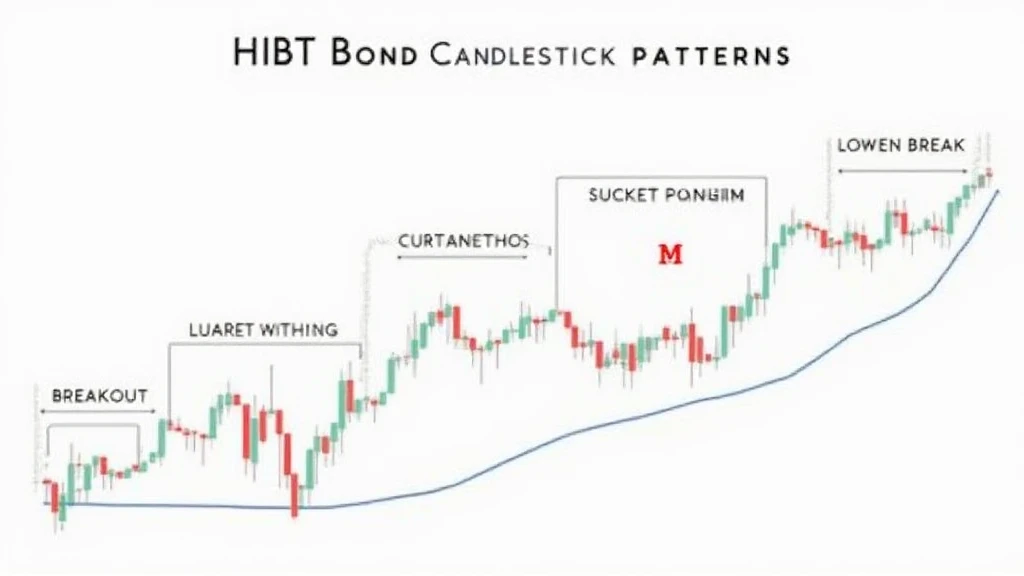

As digital assets continue to revolutionize finance, understanding the market’s trends and movements is pivotal. In 2024, it was reported that the cryptocurrency market experienced fluctuations resulting in a staggering loss of $4.1 billion due to unforeseen hacks and trades. Now more than ever, investors need to hone their skills in technical analysis, particularly in candlestick pattern recognition. This guide aims to provide insights into the HIBT bond candlestick pattern recognition guides, an essential tool for navigating the volatile crypto waters.

Understanding Candlestick Patterns

Candlestick patterns are graphical representations of price movements over a specified timeframe. Each candlestick showcases the opening, closing, high, and low prices, allowing traders to gauge market sentiment and detect potential trend reversals. Like watching the weather forecast to determine the best day for outdoor activities, understanding candlestick patterns can help traders make informed decisions about buying or selling digital assets.

The Importance of HIBT in Candlestick Patterns

In the context of candlestick patterns, HIBT (High, Inside, Bottom, Top) offers a specific method of interpretation that aids traders in spotting potential breakout areas. This method derives its strength from recognizing the psychology behind price movements. Traders using HIBT can develop a comprehensive picture of market dynamics, helping them anticipate future price actions.

How to Identify HIBT Patterns

Identifying HIBT patterns requires patience and practice. Here are steps to recognize these patterns effectively:

- Step 1: Begin by selecting a cryptocurrency asset and reviewing its historical price charts.

- Step 2: Look for candlesticks that signify a high price followed by an inside bar (where the price remains within the prior candlestick). This is the foundational element of HIBT.

- Step 3: Monitor the subsequent candlestick movement that indicates a breakout from this inside bar.

- Step 4: Confirm the breakout with volume spikes, signifying strong market interest.

- Step 5: Integrate other indicators, such as moving averages, to bolster your trade decision.

Example Scenario: HIBT in Action

Consider a cryptocurrency such as Bitcoin, which has recently experienced a bullish phase. If the Bitcoin price reaches a peak (the ‘High’), then consolidates (the ‘Inside’) before witnessing a breakout (the ‘Top’), this scenario presents a HIBT pattern. By recognizing this pattern, traders are positioned to leverage potential profit opportunities effectively.

Local Market Insights: Cryptocurrencies in Vietnam

To contextualize HIBT in real-world applications, we must examine the local market dynamics. Vietnam, a rapidly growing market for cryptocurrency, has seen a significant uptick in users, with over 15 million Vietnamese actively participating in digital asset trading. This growth signifies not only an increasing acceptance of cryptocurrencies but also the necessity for robust trading education.

With the increasing number of users in Vietnam, potential market trends can create numerous trading opportunities. Tampering with candlestick patterns, especially HIBT, can significantly enhance traders’ chances of success in a hot market like Vietnam.

Key Takeaways: Advantages of Using HIBT Patterns

- Enhanced Decision-Making: Utilizing HIBT allows traders to assess potential price movements critically and make informed trading decisions.

- Risk Management: Recognizing HIBT patterns assists traders in setting appropriate stop losses to safeguard investments.

- Compatibility with Other Strategies: HIBT patterns work seamlessly with other indicators, enriching overall market analysis.

Tools for Successful HIBT Pattern Recognition

To facilitate effective HIBT pattern recognition, traders can leverage various tools and resources:

- Trading Platforms: Utilize platforms like TradingView that offer advanced charting features, perfect for analyzing candlestick patterns.

- Educational Resources: Platforms such as HIBT.com provide extensive guides and resources that help traders deepen their understanding.

- Candlestick Pattern Software: Invest in software that specializes in pattern recognition, automating part of the process.

Conclusion

The evolving landscape of cryptocurrency demands that traders equip themselves with as much knowledge as possible. Mastering HIBT bond candlestick pattern recognition can significantly enhance a trader’s efficacy in navigating this challenging environment. As we have discussed, understanding the core principles behind this technical analysis method can lead to more informed trading decisions and ultimately better investment outcomes. Remember, the market is akin to a vast ocean; learning to read the currents can guide you toward prosperous shores. So, delve into the world of HIBT patterns and empower your trading strategies today!

For more curated insights and detailed guides, visit cryptobestnews.