Introduction

In 2024, an estimated $4.1 billion was lost to DeFi hacks, emphasizing the critical need for robust market volatility metrics. As the crypto market continues to expand, understanding these metrics is crucial for traders and investors alike. This article dives deep into the intricacies of HIBT crypto market volatility metrics, their implications, and how they can enhance trading strategies.

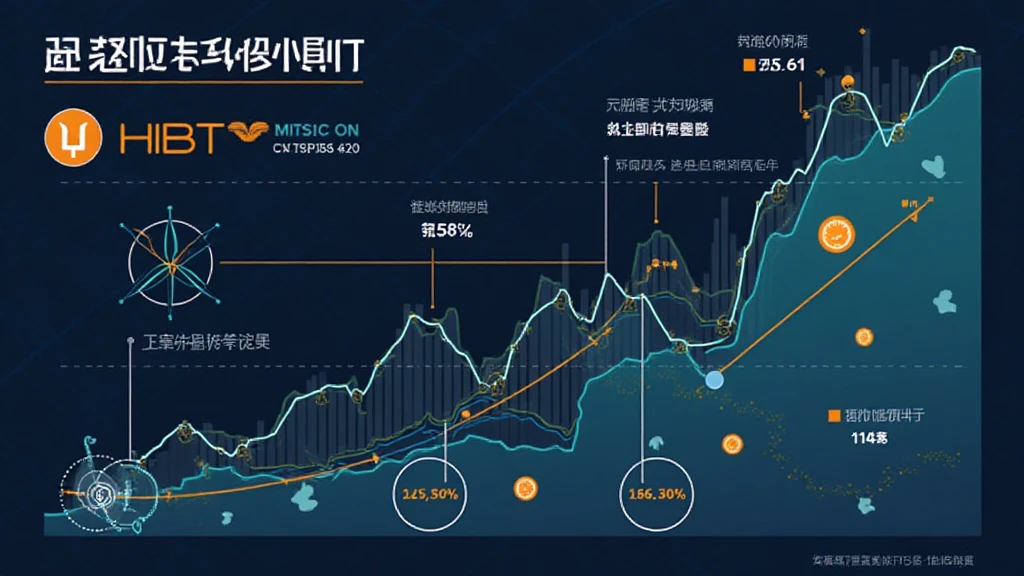

What are HIBT Crypto Market Volatility Metrics?

HIBT, or Hedged Integrated Blockchain Trading, refers to methodologies designed to measure the fluctuations within the cryptocurrency market. This includes assessing parameters such as:

- Price volatility

- Trading volume fluctuations

- Market sentiment indicators

These metrics are essential for understanding market dynamics, especially in a landscape where crypto prices can swing wildly. For instance, consider the recent spike and subsequent drop in Bitcoin prices—understanding the underlying volatility metrics could have mitigated losses for many traders.

The Importance of Market Volatility Metrics

Understanding market volatility metrics provides several benefits:

- Risk Management: By analyzing volatility, traders can make informed decisions on stop-loss orders and risk exposure.

- Market Timing: Identifying periods of high or low volatility can help traders decide when to enter or exit trades.

- Portfolio Diversification: Understanding the volatility of different assets allows for better diversification strategies.

In Vietnam, the rapidly growing user base for cryptocurrencies is indicative of the market’s potential. As per recent statistics, there was a 25% growth in the number of Vietnamese crypto users in 2024, highlighting the increasing interest in market analysis tools, including HIBT metrics.

Components of HIBT Crypto Market Volatility Metrics

HIBT metrics are multifaceted, comprising various components that traders must understand:

1. Price Volatility

Price volatility is the most straightforward metric, measuring the degree to which the price of a cryptocurrency varies over time. For instance:

- Standard Deviation: This measures how much prices deviate from their average. A higher standard deviation indicates greater volatility.

- Bollinger Bands: These use standard deviations to create channels around the price, helping traders identify potential price breakouts.

2. Trading Volume Fluctuations

Trading volume is an essential metric, as it reflects the total number of cryptocurrencies traded over a specific period. Changes in trading volume can signify:

- Market Sentiment: Increased buying or selling can indicate trader sentiment and future price movements.

- Liquidity: Higher volumes generally signify better liquidity, allowing traders to enter and exit positions more easily.

3. Market Sentiment Indicators

Sentiment analysis gauges the behavior and attitudes of market participants. Tools include:

- Fear and Greed Index: This measurement tracks sentiments and helps to predict market movements based on psychological factors.

- Social Media Trends: Analyzing Twitter and Reddit discussions can provide insights into public sentiment around specific cryptocurrencies.

How to Use HIBT Metrics in Trading

Incorporating HIBT metrics into your trading strategy involves a systematic approach:

- Regular Analysis: Conduct weekly evaluations of price volatility, trading volume, and sentiment analysis.

- Backtesting Strategies: Utilize historical data to see how your strategy performs under varying volatility conditions.

- Risk Assessment: Assess how much of your portfolio can be exposed to volatility without significant losses.

For instance, when Bitcoin experienced its recent high volatility periods, using HIBT metrics could have revealed opportunities for taking advantage of price swings.

Future Trends in Crypto Market Volatility

The crypto market is continuously evolving, and its volatility metrics will also exhibit significant changes. Analysts predict:

- Increased Institutional Investment: More institutional players entering the market can lead to heightened volatility.

- Integration of AI Tools: Advanced analytics and machine learning models may help in predicting market fluctuations more accurately.

According to Chainalysis, as of 2025, emerging middle-income countries, including Vietnam, will experience unparalleled growth in cryptocurrency adoption and trading volume due to technological advancements and decreasing barriers.

Conclusion

In conclusion, understanding HIBT crypto market volatility metrics is vital for anyone involved in crypto trading. As we navigate through a rapidly changing financial landscape, traders equipped with these insights will have the capabilities to make better, informed decisions. Keeping abreast of these metrics not only helps in risk management but also empowers traders to optimize their strategies during fluctuating market conditions. As you move forward in the crypto space, leverage these insights—your trading success will depend on it. For more resources and insights, visit HIBT.

By staying informed and adapting your trading strategies based on market volatility metrics, you set yourself up for success in this dynamic and exciting industry.

Written by Dr. Emily Tran, a blockchain security expert renowned for her publications in digital asset management and auditing methodologies, and the lead auditor on major cryptocurrency projects.