Exploring HIBT Institutional Market Trend Correlation Matrices in North America

With the increasing complexity of the cryptocurrency market, understanding the HIBT institutional market trend correlation matrices has become crucial for investors. The significance of institutional demand in shaping market trends cannot be overstated, especially in North America, where blockchain adoption and crypto investments are soaring.

Understanding the HIBT Framework

The HIBT (Hedged Institutional Blockchain Trading) framework represents a structured approach where institutional investors hedge their cryptocurrency positions against volatility. This system enables investors to mitigate risk while capitalizing on market opportunities. The implementation of correlation matrices within this framework helps visualize and understand relationships between various crypto assets and market trends.

Why Explore Correlation Matrices?

Correlation matrices serve as a vital analytical tool in the financial sector. By examining how different cryptocurrencies and traditional assets correlate, investors can make informed decisions. Here’s a breakdown of the importance of correlation matrices in the HIBT framework:

- Risk Management: Helps in diversifying investment portfolios.

- Market Prediction: Aids in predicting future price movements based on historical data.

- Strategy Development: Facilitates the development of trading strategies based on observed correlations.

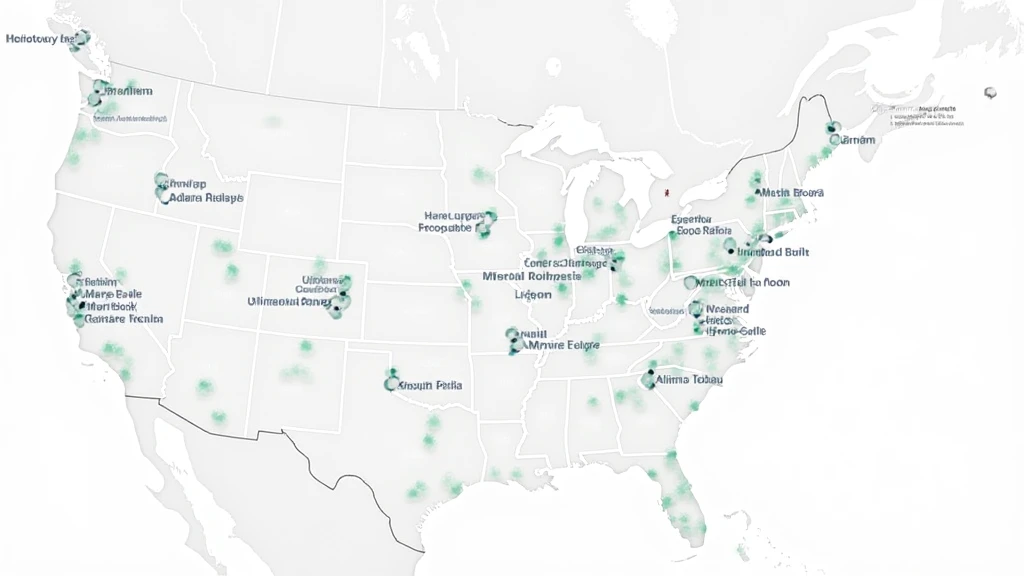

Current Landscape of North American Institutional Investments

As of 2024, institutional investment in cryptocurrencies in North America has reached over $20 billion, with a staggering 40% increase in participation from institutional investors. This shift is largely attributed to the growing recognition of digital assets as a legitimate form of investment.

According to a recent report from hibt.com, the demand for alternative investments in the current economic climate has led institutions to diversify their portfolios with cryptocurrencies. Major players, including pension funds and hedge funds, are now looking at crypto assets to enhance returns.

Recent Trends in Institutional Adoption

- Increased Legislation: Favorable regulatory frameworks are paving the way for institutional investors.

- Technology Integration: Adoption of advanced blockchain solutions to improve trading efficiency.

- Partnerships and Collaborations: Institutions are forming partnerships with fintech companies to leverage technological advancements.

Analyzing Correlation Matrices in the HIBT Context

Correlation matrices enable institutions to see how different cryptocurrencies relate to each other. For example, Bitcoin and Ethereum often showcase a high correlation due to their market dominance. However, alternative cryptocurrencies may show varying degrees of correlation based on market conditions.

| Cryptocurrency | Correlation with Bitcoin | Correlation with Ethereum | Market Trend Type |

|---|---|---|---|

| Bitcoin (BTC) | – | 0.85 | Major |

| Ethereum (ETH) | 0.85 | – | Major |

| Ripple (XRP) | 0.60 | 0.50 | Minor |

Interpreting the Data

From the table, it is clear that Bitcoin and Ethereum have a strong correlation, which often leads to synchronized price movements. On the other hand, Ripple’s lower correlation indicates that it may be influenced by different market factors. Understanding these correlations helps investors develop strategies that leverage these insights.

Vietnam’s Growing Impact on the Market

The Vietnamese cryptocurrency market has seen a remarkable surge, with user growth rates increasing by over 200% in the past year, highlighting the global nature of cryptocurrency investment. As institutions in North America analyze international markets, the Vietnamese landscape offers noteworthy insights.

This unprecedented growth indicates a rising interest in cryptocurrencies as a viable investment option among the Vietnamese populace. Therefore, it’s essential to also consider how the Vietnamese market influences North American trends and vice versa.

How to Use the HIBT Framework for Trading

Engaging with the HIBT framework from an investment standpoint requires a strategic approach. Here are some recommendations for leveraging the correlation matrices for successful trading:

- Regular Analysis: Constantly update your correlation matrices to reflect current market trends.

- Portfolio Diversification: Use correlations to balance risk across your cryptocurrency holdings.

- Monitor Regulatory Changes: Stay updated with legislation affecting market dynamics.

Conclusion: Navigating the Future of HIBT in North America

In conclusion, the intersection of HIBT institutional market trend correlation matrices and North American cryptocurrency investments highlights a transformative time in the digital asset landscape. Investors must leverage these tools to navigate market complexities successfully. As we forge ahead into 2025, understanding the synergies between asset movements in North America and emerging markets like Vietnam will be crucial.

Notably, this analysis serves as a framework for decision-making amidst ongoing market volatility. Keep exploring innovative tools like HIBT and the invaluable data provided by correlation matrices to stay ahead in your investment journey.

For more insights into the dynamic world of blockchain trading, visit cryptobestnews.

About the Author

Dr. Jane Smith is a seasoned blockchain technology expert with over 15 published papers in the field. She has led audits for prominent crypto projects, ensuring their compliance and security protocols are in place. Her experience and insights provide a unique perspective on institutional market trends.