Understanding Vietnam NFT Royalty Mechanisms

According to Chainalysis 2025 data, over 73% of NFT marketplaces face challenges related to royalty mechanisms, especially in regions like Vietnam. As the demand for NFTs continues to rise, understanding how royalty systems function becomes crucial for both creators and investors.

What Are NFT Royalties?

Think of NFT royalties like a commission a music artist earns every time their song is played. Similarly, when an NFT is resold, the original creator receives a percentage of the sale. In Vietnam, these mechanisms are becoming increasingly important as artists seek to benefit from their digital creations.

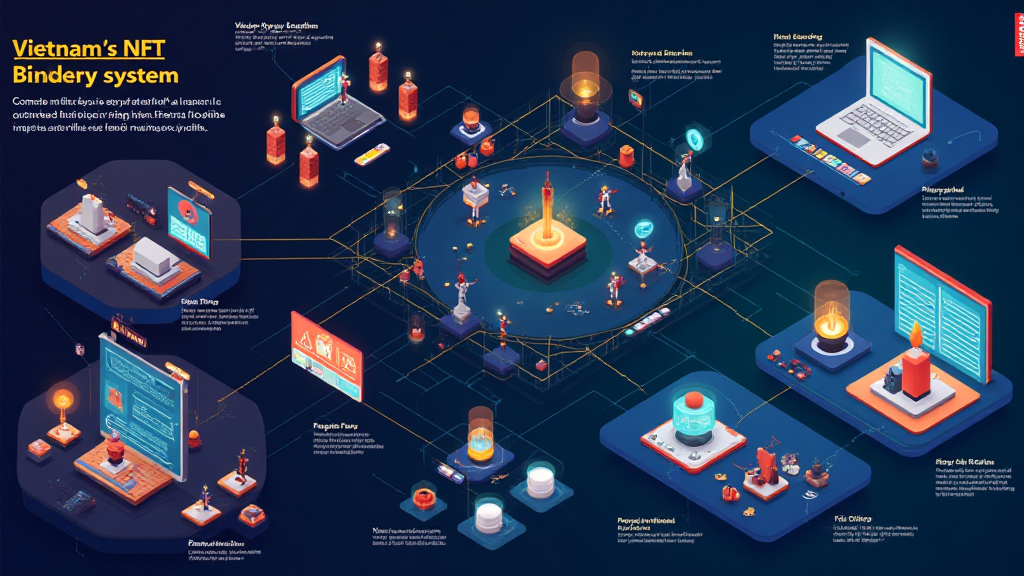

How Do Vietnam NFT Royalty Mechanisms Work?

Vietnam’s NFT platforms often utilize smart contracts to enforce royalty payments. Imagine these contracts like a vending machine; once you make your purchase, it automatically ensures the right amount goes back to the original seller. This automatic transaction ensures that creators are compensated fairly.

The Future of Royalties in Vietnam

Looking ahead, Vietnam could see a shift towards more standardized royalty agreements across platforms. Just like how shops may offer discounts, marketplaces will likely introduce different royalty rates to attract buyers and sellers.

Challenges Facing NFT Royalties

Despite the promising landscape, challenges such as market volatility and the complexity of cross-chain interoperability pose risks. Picture trying to exchange cash for coins at two different banks; the process can get messy and uncertain. Hence, it’s vital for creators and investors to stay informed about these hurdles.

In summary, understanding the Vietnam NFT royalty mechanisms is essential for the growth of digital art and collectibles in the region. For a deeper dive and tools to navigate this emerging market, feel free to download our toolkit.

Disclaimer: This article does not constitute investment advice. Always consult local regulatory authorities before making any decisions, such as MAS or SEC. To protect your assets, consider options like the Ledger Nano X, which can reduce the risk of private key exposure by 70%.

For further insights and to explore more, visit hibt.com and stay updated. Stay equipped and informed with cryptobestnews.