Bitcoin Halving Market Forecasts: The Impact on Future Prices

According to Chainalysis, 2025 could see a transformative year for Bitcoin, with potential volatility due to the upcoming halving event. Historically, halving events have led to significant price increases, impacting both long-term investors and day-traders alike. As nearly 3,000 blocks are mined in the lead-up to the halving, traders are anticipating how supply reduction will affect market dynamics.

Understanding Bitcoin Halving

So, what exactly is Bitcoin halving? Think of it like this: when you bake cookies, every batch you make uses a certain amount of ingredients. Halving means you only get to bake half as many cookies with the same inputs—this makes each cookie more valuable! Similarly, Bitcoin halving reduces the rewards miners earn, which could lead to increased demand and consequently drive prices up. This concept lays the groundwork for understanding Bitcoin halving market forecasts and their implications for investors.

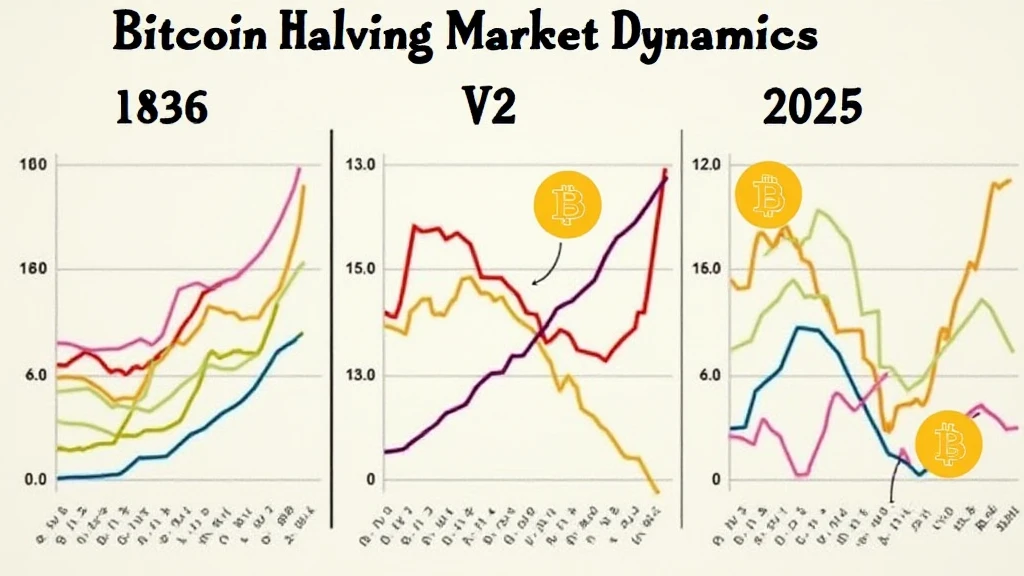

The Historical Impact of Bitcoin Halving on Prices

Looking back, each halving event has led to significant price spikes. For example, after the 2016 halving, Bitcoin surged from about $450 to nearly $20,000 by the end of 2017. As analysts forecast similar trends for the next event, questions arise around the sustainability of such price increases. Just like predicting the weather, it’s essential to consider external factors. For instance, if more institutions start accepting Bitcoin, we might see more robust movements post-halving.

Market Sentiment Leading Up to Halving

Market sentiment plays a crucial role in shaping Bitcoin halving market forecasts. If traders are feeling optimistic, they might push prices higher as the halving date approaches. Conversely, fear can lead to quick sell-offs. You might’ve seen a pattern where positive news leads to a surge, while negative news triggers panic selling. Hence, monitoring social media trends and news provides valuable insights, acting like signals that guide traders through uncertain waters.

Future Trends: What 2025 Holds for Bitcoin

Looking forward to 2025, several key factors could influence Bitcoin’s trajectory. For instance, the integration of DeFi platforms in regions like Dubai could provide additional liquidity and usage. In contrast, varying regulatory frameworks—like Singapore’s evolving DeFi regulations—can shape market sentiment. Stacking these elements together, there is a strong possibility that Bitcoin could see sustained growth, but not without hurdles. Catastrophic events, like major exchange hacks, could complicate predictions, much like a sudden rainstorm ruining a sunny picnic.

Conclusion and Toolkit Download

In summary, the Bitcoin halving event has historically influenced market prices significantly. With the 2025 halving on the horizon, traders should pay close attention to market sentiment and external conditions. For practical tips and strategies to navigate these shifts, don’t forget to download our comprehensive toolkit.

Download your Bitcoin trading toolkit here!

Disclaimer: This article does not constitute investment advice. Please consult with local financial regulators before making investment decisions.

Tools like the Ledger Nano X can significantly reduce the risk of a private key breach, by up to 70%. Make sure your assets are safe!

— cryptobestnews