Understanding Blockchain Bond Market Liquidity in Vietnam

According to Chainalysis 2025 data, 73% of the global blockchain bond market faces significant liquidity challenges. This insight highlights the need for effective solutions to enhance market efficiency in countries like Vietnam. The rise of digital assets has introduced various innovative technologies, yet the liquidity of blockchain bonds remains a complex issue that requires immediate attention.

What is Blockchain Bond Market Liquidity?

Blockchain bond market liquidity refers to how easily bonds can be bought or sold in the market without causing price changes. Imagine a busy fish market; if you can sell your fish quickly at a fair price, that’s great liquidity. But if everyone is trying to sell the same type of fish at once, prices can drop. Similarly, liquidity in the bond market is crucial for ensuring stable investments.

Why is Liquidity Important for Investors?

Investors depend on liquidity to enter and exit positions smoothly. In Vietnam, increasing liquidity in blockchain bonds could attract foreign investments. Think of liquidity as the difference between a well-stocked convenience store and a deserted one; the more options available, the more likely people are to come in and make purchases. Having a thriving market can foster confidence among investors.

Challenges Facing Vietnam’s Blockchain Bond Liquidity

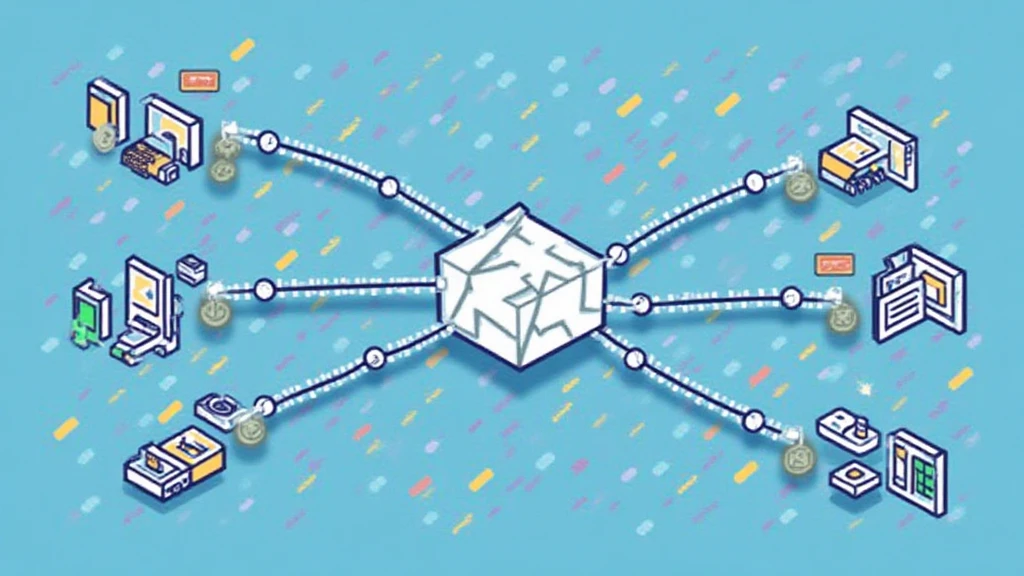

Vietnam faces several unique challenges in boosting its blockchain bond market liquidity. Regulatory frameworks are still in development, leading to uncertainty among potential investors. Additionally, with local infrastructure evolving, the market requires robust solutions for cross-chain interoperability to facilitate smoother transactions. Just like a bridge helps cars cross a river, effective technology can link various blockchains to improve liquidity.

Future Prospects: Enhancing Liquidity Strategies

To enhance liquidity in Vietnam’s blockchain bond market, adopting zero-knowledge proofs can secure transactions while ensuring privacy. This technology allows verification without revealing private information, akin to a sealed envelope confirming your identity without exposing the contents inside. As the market matures, investors will be looking for tools and platforms to increase their engagement.

In conclusion, addressing the liquidity issues in Vietnam’s blockchain bond market is crucial for attracting investment and improving market health. Interested parties can download our comprehensive toolkits to get started on enhancing liquidity strategies.