Understanding HIBT Enterprise Margin Trading Liquidation Process Guides in Asia

With the Asian cryptocurrency trading market expanding rapidly, margin trading has gained immense popularity among investors. As of 2023, the number of cryptocurrency users in Vietnam alone has grown by 40%, illustrating the region’s increasing interest in digital assets. However, margin trading comes with its own set of risks, particularly when it comes to liquidation processes. In this comprehensive guide, we will delve into the HIBT enterprise margin trading liquidation process, offering useful insights, practical examples, and strategies for traders navigating this complex landscape.

What is Margin Trading?

Margin trading involves borrowing funds from a broker or trading platform to increase potential returns on investment. This method allows traders to open larger positions than they could with their own capital alone. However, it also exposes them to greater risks, particularly if the market moves against their positions.

In margin trading, the concept of liquidation is crucial. When losses reach a certain threshold, the trading platform may liquidate positions to prevent further loss. This process ensures that traders can cover their losses and protects the platform from financial default.

Understanding the Liquidation Process

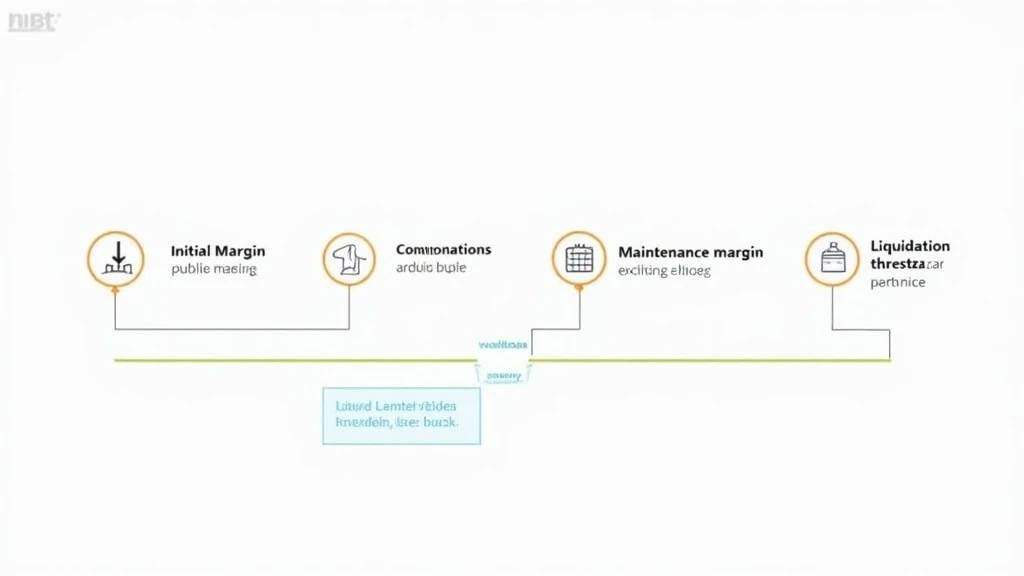

The liquidation process in margin trading is initiated when a trader’s equity falls below the required maintenance margin. This point is typically set by the platform and aims to safeguard both the trader and the platform.

- Initial Margin: The percentage of the purchase price that the trader must fund with their own capital.

- Maintenance Margin: The minimum equity required to keep a position open. If the equity dips below this level, a margin call is triggered.

- Liquidation Threshold: The point at which the platform will automatically close the trader’s positions to mitigate losses.

For example, if you open a position worth $10,000 with an initial margin of 10%, you would invest $1,000 of your own funds while borrowing $9,000. Should your trading account balance drop to $600, triggering the maintenance margin, the platform will liquidate your position to prevent further losses.

Key Considerations for Asian Traders

As an emerging hub for cryptocurrency trading, Asia presents unique challenges and opportunities for traders. Here are some factors to consider when engaging in margin trading:

- Market Volatility: The Asian crypto market is known for its rapid fluctuations. Staying updated with market trends is crucial.

- Regulatory Environment: Different countries have varying regulations concerning margin trading. It is imperative to stay informed about local laws.

- Liquidity Risks: Margin trading can lead to liquidity problems, especially during volatile market conditions. Ensure you choose a reputable trading platform with adequate liquidity.

Effective Risk Management Strategies

To navigate the intricacies of margin trading and the liquidation process, it is essential to adopt effective risk management strategies:

- Set Stop-Loss Orders: Implement stop-loss orders to minimize potential losses and avoid liquidation.

- Limit Leverage: Utilize lower leverage ratios to decrease the risks associated with margin trading.

- Continuous Monitoring: Keep a close watch on your account and the market to react swiftly to movements.

Real-World Scenario: Vietnamese Market Insights

Vietnam’s cryptocurrency market is rapidly evolving, with an increased number of users engaging in margin trading activities. It is estimated that by 2025, the Vietnamese cryptocurrency sector will witness a growth rate of 45%, driven by a young, tech-savvy population.

Table: Key Market Metrics in Vietnam (2025)

| Metric | Value |

|---|---|

| Users | 10 Million+ |

| Market Growth Rate | 45% |

| Margin Trading Volume | $500 Million |

This growth further highlights the importance of understanding the HIBT enterprise margin trading liquidation process, ensuring traders are equipped with the necessary knowledge to mitigate risks and optimize their trading strategies.

Future Trends in Margin Trading

Looking ahead, several trends in margin trading are likely to emerge in the Asian market, driven by advancements in technology and regulatory evolutions:

- Increased Use of Algorithms: Algorithms will lead to more efficient trading and liquidation processes.

- Decentralized Trading Platforms: The rise of decentralized platforms may transform traditional margin trading by empowering users to maintain more control over their assets.

- Enhanced Security Measures: As cyber threats persist, platforms will prioritize robust security measures, including comprehensive tiêu chuẩn an ninh blockchain protocols.

Conclusion

Understanding the HIBT enterprise margin trading liquidation process is vital for traders operating in Asia, particularly in the fast-growing Vietnamese market. By implementing effective risk management strategies and staying informed about market developments, traders can navigate the complexities of margin trading successfully.

For further information on margin trading and its associated risks, visit hibt.com. Here at cryptobestnews, we provide up-to-date insights and guidelines to assist you in your trading journey. Always remember to do your own research and consult local regulations.