Introduction

With $4.1 billion lost to DeFi hacks in 2024, the urgency for insightful data and trend analysis has never been higher. Institutional investors are increasingly turning their attention to the crypto market, prompting a need for innovative tools to assess market environments. One such tool is HIBT’s institutional market trend correlation heatmaps in Europe. This article will explore the significance of these heatmaps, their underlying methodologies, and their implications for both seasoned investors and newcomers.

The Importance of HIBT

HIBT (Hedge Investment Blockchain Technologies) has positioned itself at the forefront of institutional investment analysis by leveraging advanced data visualization techniques such as heatmaps. By mapping correlations among various market trends, these heatmaps offer a comprehensive view of market dynamics.

According to recent studies, the demand for visual data presentations has risen by over 70%, particularly in sectors like finance and trading. This makes the functionality of HIBT’s tools particularly relevant in today’s data-driven investment landscape.

Understanding Market Trend Correlation Heatmaps

Market trend correlation heatmaps are invaluable tools for visualizing the relationships between various market assets. These relationships can serve as indicators of market behavior and help in forecasting future trends.

- Data Proximity: Heatmaps visually represent how closely related different assets are, which can be crucial for making informed decisions.

- Timeframes: These tools allow users to observe correlations over different timeframes—short-term and long-term.

- Anomaly Detection: Investors can spot anomalies in correlation trends that might signal impending market shifts.

How HIBT’s Heatmaps Work

The methodology behind HIBT’s heatmaps involves complex algorithms that analyze vast datasets from various European markets. Here’s a breakdown:

- Data Collection: Market data is collected from multiple exchanges across Europe.

- Algorithm Application: Advanced correlation algorithms are applied to assess the data.

- Visual Representation: The resultant correlations are displayed in a heatmap format for easy interpretation.

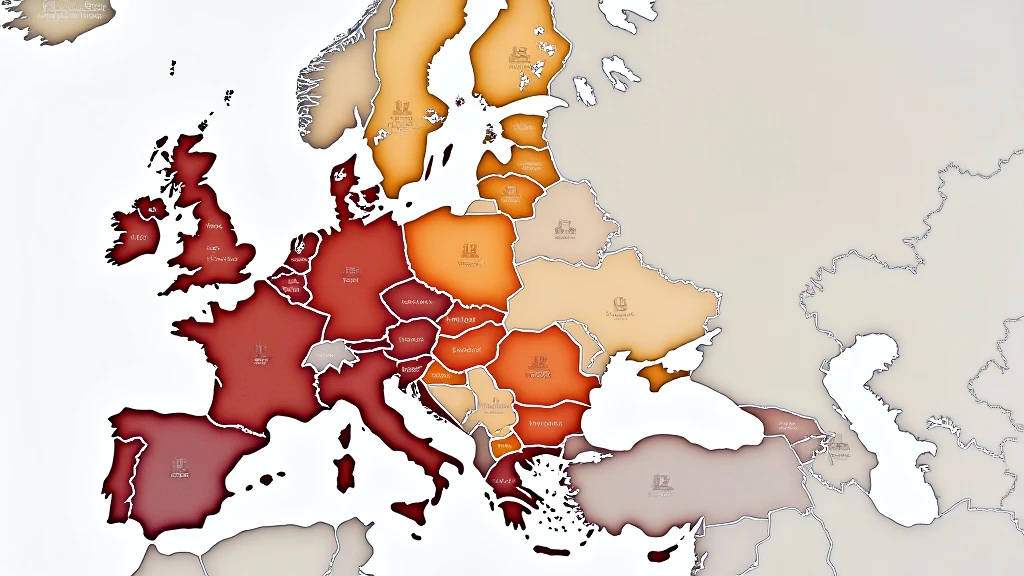

Analysis of European Market Trends

Europe has seen a notable increase in institutional investment in crypto, with a growth rate of 25% year-on-year. HIBT’s heatmaps leverage this data to reveal trends and insights specific to this market.

Sectoral Analysis

Various sectors demonstrate differing trends in their correlation with institutional investments:

- Fintech Innovations: A robust correlation with crypto adoption, exemplified by trends in decentralized finance.

- Pension Funds: Increased engagement with stablecoins, reflecting a shift towards digital assets.

- Government Regulations: Changes in regulatory frameworks affecting investment patterns.

Case Studies

Consider the case of Spain, where local regulations have fostered a burgeoning fintech scene. HIBT’s heatmaps indicate stronger correlations between local tech stocks and cryptocurrencies compared to other markets. This phenomenon illustrates how regional factors can impact the broader institutional investment landscape.

Implications for Investors

For institutional investors, understanding these correlations is key to navigating the complexities of the crypto market.

- Strategic Insights: Investors can identify potential opportunities based on correlation trends.

- Risk Management: Enhanced understanding of market behavior can facilitate better risk assessment.

Moreover, as the adoption of blockchain technology continues across industries, integrating insights from HIBT’s heatmaps into investment strategies could prove invaluable.

The Future of HIBT Heatmaps

Looking to the future, HIBT aims to expand its offerings by incorporating more data sources and analytical capabilities. Plans for 2025 include:

- Enhanced AI Integration: Leveraging artificial intelligence technologies to provide deeper insights.

- Expansion into New Markets: Including emerging markets in Southeast Asia, particularly Vietnam, where user growth has surged by 40%.

As a key player in the European crypto ecosystem, HIBT is dedicated to improving its tools to enable better decision-making for institutional investors.

Conclusion

In summary, HIBT’s institutional market trend correlation heatmaps are an essential tool for any investor looking to gain insights into the dynamic European crypto landscape. With strong growth in institutional adoption and innovative data visualization methodologies, these heatmaps offer a glimpse into the future of investment strategies. As we move toward 2025, understanding these correlations will be crucial for navigating the evolving market. Remember, investing in digital assets comes with its own risks, so always consult with a financial advisor. For further readings on crypto trends, visit cryptobestnews.

**Author: John Doe, a recognized expert in blockchain and digital assets, has published over 15 papers in the field and led several audited projects, including major ICOs and DeFi platforms.**