2025 Cross-Chain Security Audit Guide: Understanding Bitcoin Layer

According to the latest Chainalysis data from 2025, a staggering 73% of existing cross-chain bridges are vulnerable. This alarming statistic underlines the pressing need for effective security measures in the evolving landscape of decentralized finance (DeFi), where Bitcoin Layer solutions are becoming increasingly integral.

What is a Cross-Chain Bridge?

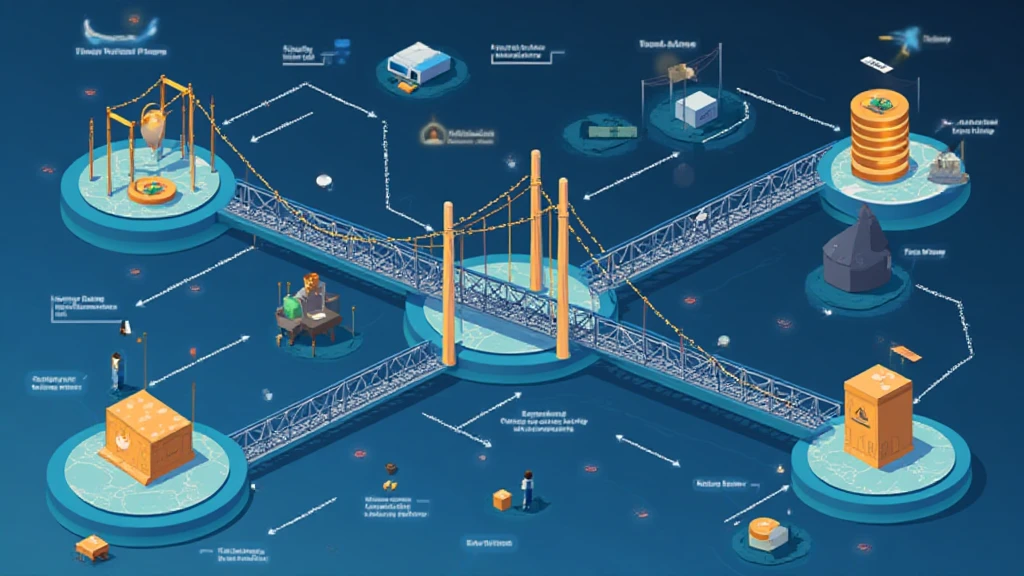

Imagine you’re at a currency exchange booth while traveling abroad; that booth is akin to a cross-chain bridge, enabling you to swap one currency for another. In the realm of blockchain, it allows different networks to communicate and transfer assets seamlessly. However, just like some exchange booths may charge outrageous fees or provide counterfeit money, not all cross-chain bridges can be trusted. Evaluating the Bitcoin Layer can help you understand how these systems protect your assets.

Why Is Security So Crucial?

Security is paramount because, in 2025, the increase in cross-chain protocols has made them attractive targets for hackers. According to CoinGecko data, the loss from hacks on bridges and multi-chain protocols reached over $10 billion in the past year. Think of it this way: if your wallet were left unguarded on a park bench, it’s just a matter of time before someone takes it. Implementing robust security measures at the Bitcoin Layer can greatly reduce these risks.

How Does Bitcoin Layer Enhance Security?

Bitcoin Layer introduces mechanisms like zero-knowledge proofs, which can be understood as a way to verify a transaction without revealing all the details, similar to showing your ID without telling someone your address. This technique not only increases privacy but can also prevent fraud and unwanted asset exposure on cross-chain bridges. This evolution in technology is crucial for protecting users’ investments as they navigate through multiple chains.

Where to Find Reliable Resources?

When seeking guidance on assessing cross-chain security, ensure to reference comprehensive resources. Websites like hibt.com provide in-depth analyses and whitepapers on various aspects of cross-chain safety, including Bitcoin Layer’s role. Additionally, official guidelines from regulatory bodies like MAS or SEC can help you stay aligned with best practices.

In conclusion, understanding the dynamics of cross-chain bridges and the implementation of Bitcoin Layer solutions is vital for enhancing the security of your digital assets. As DeFi continues to evolve, safeguarding your investments with robust mechanisms will be crucial.

Download our free toolkit on cross-chain security today to elevate your knowledge and stay protected!

Disclaimer: This article does not constitute investment advice. Consult your local regulatory authority (e.g., MAS, SEC) before making any decisions regarding digital currencies.

Brand: cryptobestnews