2025 Cryptocurrency Bond Collateral Management Trends

According to Chainalysis data from 2025, a staggering 73% of organizations involved in cryptocurrency bond collateral management have experienced vulnerabilities in their systems. This highlights an urgent need for enhanced security and better management practices in this rapidly evolving financial landscape.

Section 1: Understanding Cryptocurrency Bond Collateral Management

To put it simply, managing collateral in cryptocurrency bonds is like balancing groceries in a shopping cart. If you have too many items that are not properly secured, you’re likely to lose something valuable along the way. In the cryptocurrency world, collateral management ensures that the bonds created using digital assets remain secure and feasible.

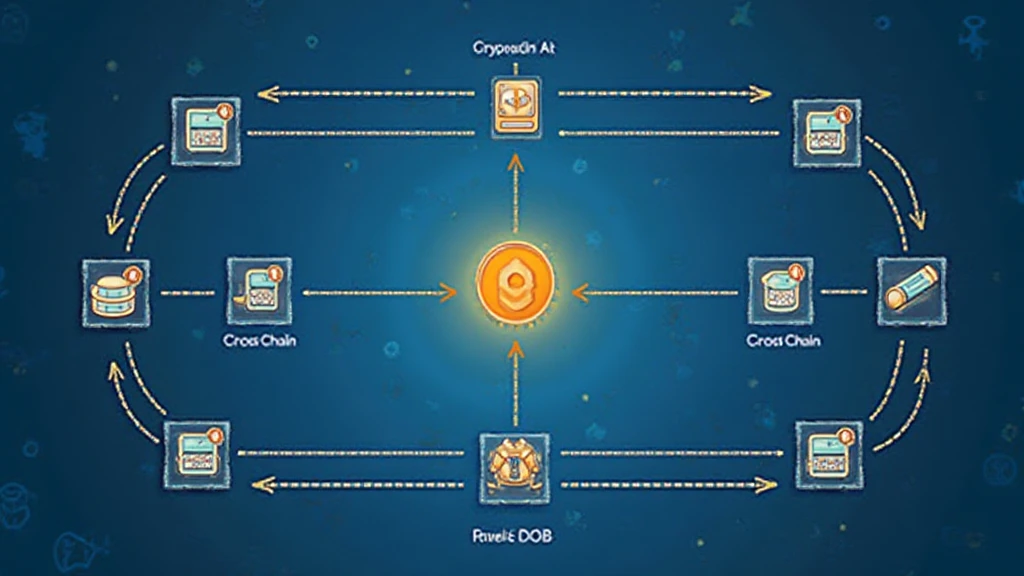

Section 2: The Role of Cross-Chain Interoperability

You might have seen how that neighborhood money exchange service works. Cross-chain interoperability acts similarly by allowing different blockchains (like Ethereum and Bitcoin) to interact with each other, making it easier to manage bonds across various platforms. This capability can significantly enhance liquidity and reduce risks associated with asset management.

Section 3: Zero-Knowledge Proofs and Their Implications

Imagine proving you have enough money to buy groceries without showing all your receipts. That’s what zero-knowledge proofs do in the cryptocurrency world. They enable users to validate information without revealing sensitive details, thereby enhancing privacy and security in the management of crypto bonds.

Section 4: Trends in DeFi Regulations in Singapore by 2025

As you may have noticed, regulations surrounding decentralized finance (DeFi) are tightening globally, particularly in places like Singapore. Expect a framework that promotes safe investment environments and sets forth guidelines on collateral management for crypto bonds, vastly improving user trust. This regulatory clarity will foster a healthier market landscape.

In summary, cryptocurrency bond collateral management is evolving rapidly, particularly with the integration of cross-chain interoperability and zero-knowledge proofs. To understand how to navigate these challenges, feel free to download our comprehensive toolkit on best practices in digital asset management.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult with local regulatory authorities such as MAS or SEC before making investment decisions.

Tools Mentioned: Using a Ledger Nano X can significantly lower your risks of private key exposure by up to 70%.