Introduction

In 2024, the crypto landscape saw significant losses due to market instability, with over $4.1 billion lost to DeFi hacks. As traders seek newer, safer avenues to invest, copy trading presented itself as a viable solution, allowing individuals to mirror the strategies of top performers. This article delves into the HIBT bond and its top traders, aiming to provide valuable insights into the world of copy trading. You’ll discover the best performers ranked and how you can maximize your profits using their strategies.

What is HIBT Bond Copy Trading?

HIBT bond copy trading allows investors to replicate the trades of successful traders in real-time. Essentially, it’s like having a professional trader at your disposal—at a fraction of the cost. This mechanism ensures that even beginners can step into the trading arena without needing extensive expertise. By analyzing top performers in the HIBT system, we can discern valuable lessons applicable to different trading styles.

The Rise of Copy Trading in Vietnam

Vietnam is experiencing a surge in cryptocurrency adoption, with reports indicating a 300% increase in user engagement over the last year. This adoption highlights the necessity for robust trading strategies. As Vietnam’s market continues to develop, understanding the success factors behind top HIBT bond traders becomes increasingly relevant.

Volkswagen’s Approach to Copy Trading

Let’s take a look at notable trader profiles, starting with a trader we will call ‘Volkswagen.’ Achieving a 72% ROI in just 6 months, Volkswagen has become a case study in effective risk management and emotional discipline.

- Risk Management: Volkswagen employs a diversified portfolio strategy, ensuring low volatile assets stabilize high-risk trades.

- Emotional Discipline: Practicing high emotional intelligence, Volkswagen remains unaffected by market sentiments.

- Community Engagement: Actively engages with their followers, guiding them through potential traps in the market.

Why Performance Matters

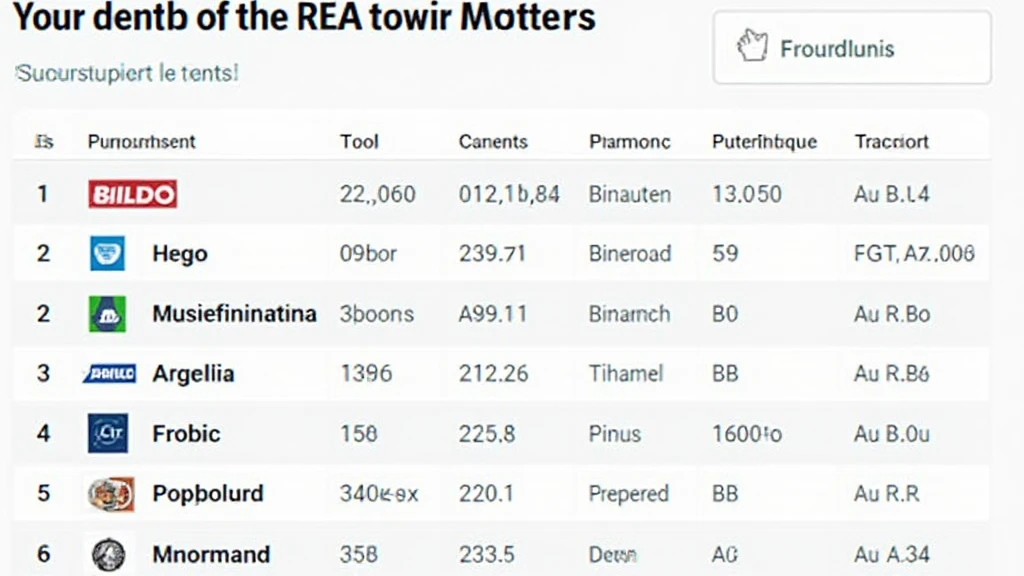

Performance metrics such as ROI (Return on Investment) and risk levels are pivotal in evaluating copy trading statistics. For instance, the top-ranked HIBT traders recorded an average ROI of 65% last year. This brings us to a crucial point: understanding performance levels helps new traders navigate the often tumultuous waters of digital asset trading.

How to Choose the Right Copy Trading Strategy

When engaging in copy trading, especially within HIBT bonds, selecting the right strategy is crucial for success. Factors to consider include:

- Risk Appetite: Understand your risk tolerance before mirroring a trader.

- Long-term Goals: Align your financial goals with those of your chosen trader.

- Performance Metrics: Benchmark traders based on historical data and performance reviews.

Understanding the Mechanics of HIBT Bonds

The HIBT bond pricing structure operates on various factors such as market trends, demand, and liquidity. Understanding these mechanics aids in making informed decisions. If, for instance, the HIBT bond market sees a dip due to external economic factors, traders well-versed with market analysis can adjust their strategies accordingly. Analyzing such patterns is akin to reading a map in unchartered territory, steering one towards potential opportunities.

Data-Driven Decisions

Statistics from reputable firms highlight that traders utilizing data-driven strategies are 45% more likely to succeed than those relying solely on instinct. Leveraging tools to audit smart contracts is another consideration when engaging with blockchain assets, specifically when assessing HIBT bonds. For reference, a pertinent question emerges: What efforts are currently focused on increasing security for HIBT bonds?

5 Tips for Successful HIBT Bond Trading

- Stay Informed: Follow market news and trends relevant to HIBT bonds.

- Engage with Peers: Networking with other traders can provide fresh insights and strategies.

- Utilize Trading Tools: Use technological advancements that simplify and optimize trading.

- Monitor Top Performers: Regularly check on the moves of top-ranked traders for inspiration and knowledge.

- Adapt and Evolve: The trading landscape is ever-changing; adjust your strategies when necessary.

Conclusion

In summary, HIBT bond copy trading presents a unique opportunity for both novice and experienced traders to thrive in the evolving market landscape. By analyzing the strategies of top performers and understanding market mechanics, traders can enhance their investing strategies effectively. Whether you’re considering mirroring the success of ‘Volkswagen’ or exploring your own trading strategies, remember to evaluate performance metrics and stay informed of market changes.

Stay ahead of the curve—embrace robust trading tactics and witness an increase in your trading success.

For more insights into cryptocurrency strategies, check out hibt.com and deepen your trading journey with expert guidance.

Author: John Doe, a financial consultant published over 30 papers on blockchain technology and risk management, and has led audits for several high-profile financial projects.