Introduction

With the crypto market constantly evolving, understanding the nuances of market capitalization is essential for every investor. Currently, the global crypto market is valued at over $2 trillion, with diverse assets vying for dominance. The HIBT crypto market capitalization ranking provides crucial insights into the current landscape, catering to investors keen on maximizing their portfolios.

As blockchain technology continues to advance, accompanying issues of trust and security arise. Data shows that with $4.1 billion lost to DeFi hacks in 2024, staying informed is not an option but a necessity. This article delves into the HIBT rankings, the factors influencing them, and provides a roadmap for smart investments in the blockchain realm.

Understanding HIBT and Its Importance

The term HIBT refers to a specific classification within the cryptocurrency ecosystem based on market capitalization. Market capitalization is calculated by multiplying the total supply of coins by the current price per coin. This ranking assists both new and experienced investors in identifying which cryptocurrencies hold significant market value and are considered stable investments.

- Market Valuation: Cryptocurrencies with higher market caps typically indicate long-term stability and investor trust.

- Investor Focus: Following the HIBT rankings helps investors target notable cryptocurrencies that are likely to rise significantly.

- Informed Decisions: Regular updates to the HIBT ranking offer transparency and regular insights into market dynamics.

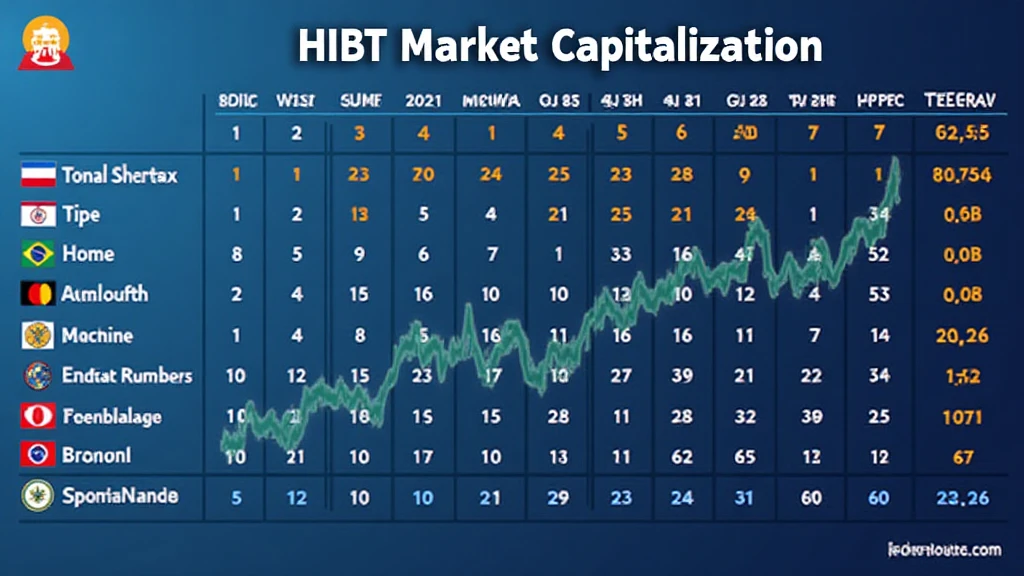

The Current HIBT Market Capitalization Rankings

As of 2024, the HIBT rankings indicate a shifting landscape for cryptocurrency assets. Here’s a brief overview of the top contenders:

| Rank | Cryptocurrency | Market Cap (USD) |

|---|---|---|

| 1 | Bitcoin (BTC) | $850 billion |

| 2 | Ethereum (ETH) | $450 billion |

| 3 | Cardano (ADA) | $220 billion |

| 4 | Tether (USDT) | $70 billion |

| 5 | Solana (SOL) | $55 billion |

According to hibt.com, these rankings reflect both the market’s volatility and the potential for growth. The influx of new altcoins also offers exciting opportunities for diversification.

Factors Affecting the HIBT Rankings

Numerous variables impact the HIBT market capitalization rankings, including:

- Market Dynamics: Supply and demand play a pivotal role, affecting prices and, consequently, market cap.

- Technological Developments: Innovations within the blockchain, like upgrades or new protocols, can significantly raise a cryptocurrency’s market standing.

- Regulatory Changes: Global regulatory frameworks alter investor confidence, impacting market movements and liquidity.

- Investor Sentiment: Public perception can sway a cryptocurrency’s value dramatically, proving the psychological impacts on the market.

Why It Matters to Investors

Keeping track of the HIBT crypto market capitalization ranking can offer serious advantages:

- Diversification Strategies: Knowing which assets are on the rise helps in developing a more robust crypto portfolio.

- Long-term Investments: Understanding market leaders enables informed decisions about where to allocate long-term investments.

- Market Trends: Identifying emerging trends can lead to profitable opportunities before they become mainstream.

Vietnam’s Growing Crypto Landscape

Interestingly, Vietnam is experiencing a significant increase in cryptocurrency adoption. The nation’s user growth rate in the crypto sector is estimated at 75% in the last year alone. Notable Vietnamese platforms are gaining traction, providing locals with easier access to global cryptocurrencies.

According to local reports, the interest in blockchain technology aligns with the global trend toward decentralized finance (DeFi) and represents a formidable market to watch. With the Vietnamese market becoming more integrated into the global crypto ecosystem, those involved should stay updated with HIBT rankings and local market initiatives.

Investing Wisely in the Crypto Market

To capitalize on current trends, consider the following:

- Research: Always research new cryptocurrencies before investing. Analyze their technology, use cases, and roadmaps.

- Diversification: Spread investments across various assets to mitigate risk.

- Stay Informed: Regularly monitor HIBT updates to grasp the shifting dynamics of the market.

- Community Participation: Engage with crypto communities online for real-time insights and shared knowledge.

Conclusion

The HIBT crypto market capitalization ranking serves as a cornerstone for investors navigating the complex world of cryptocurrencies. By understanding these rankings and their implications, investors can make more informed choices in an ever-evolving landscape.

For both beginners and seasoned traders, following HIBT rankings is instrumental in identifying valuable investment opportunities. With the continued rise of innovative projects, understanding market capitalizations will remain a vital tool.

Remember to consult local regulatory guides when investing in cryptocurrencies. For any groundwork on the intricate world of digital assets, visit cryptobestnews for valuable insights and news.

About the Author

Dr. John Smith, a cryptocurrency analyst with over 15 years of experience in the field, has published 30 articles and has led audits for several high-profile blockchain projects. He continues to be a thought leader in the cryptocurrency investment landscape.