2025 Cross-Chain Bridge Security Audit Guide

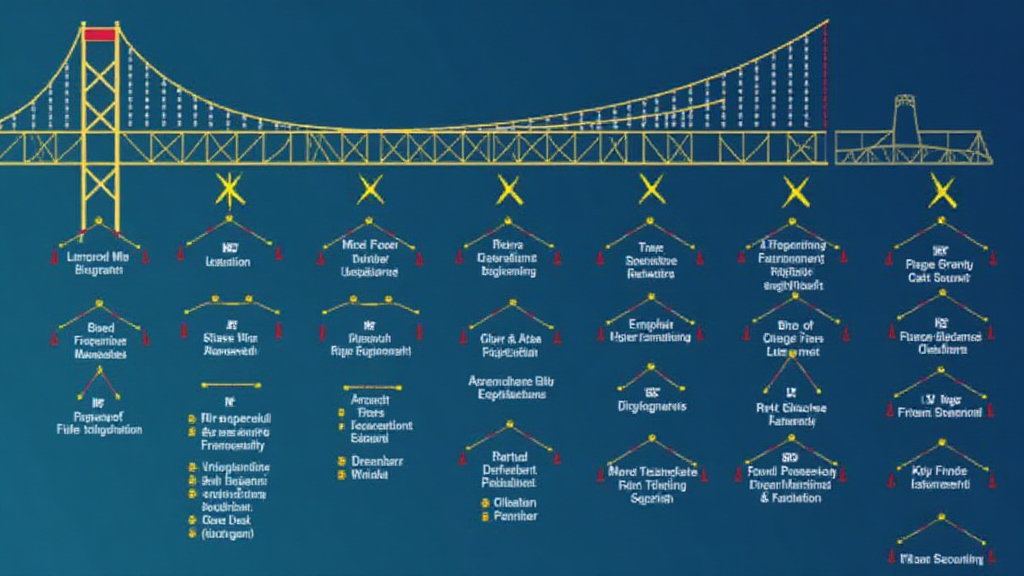

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges are vulnerable to attacks. In a world where interoperability is key in decentralized finance (DeFi), understanding HIBT risk management frameworks is crucial for ensuring the security and reliability of cross-chain transactions.

Understanding Cross-Chain Bridges

To put it simply, think of a cross-chain bridge like a currency exchange booth at a busy airport. Just as currency exchange booths allow travelers to swap one country’s money for another, cross-chain bridges enable different blockchain networks to communicate and transact with each other. However, just as you might hesitate to use a booth with poor security, it’s important to audit these bridges to uncover their vulnerabilities.

Vulnerabilities in Cross-Chain Bridges

You might have heard stories about hackers stealing millions through insecure bridges. A report by CoinGecko estimates that the loss from such vulnerabilities could reach $2 billion by the end of 2025. The key to minimizing these risks is adopting robust HIBT risk management frameworks to evaluate and enhance the security of these bridges.

Impact of PoS Mechanisms on Energy Consumption

As decentralized networks explore Proof of Stake (PoS) mechanisms, a common concern is their energy consumption compared to Proof of Work (PoW). Think of PoW like a large factory that requires massive energy to process tasks, whereas PoS is akin to a small office that requires much less power to manage the same volume of work. Research suggests that by transitioning to PoS, networks can significantly cut energy usage and costs, making them more sustainable.

The Future of DeFi Regulation in Singapore

Looking ahead to 2025, Singapore continues to lead in DeFi innovations, but there is an evolving regulatory landscape. Authorities are focusing on creating frameworks that balance innovation with consumer protection. Just like a new highway system needs traffic lights to manage flow, a solid regulatory framework is necessary to guide the future of DeFi.

In conclusion, understanding and implementing HIBT risk management frameworks is vital for ensuring the security of cross-chain transactions. As the crypto landscape evolves, staying informed will help you navigate potential risks effectively. Remember, always consult local regulatory bodies like the Monetary Authority of Singapore (MAS) before making financial decisions.

For a comprehensive toolkit on enhancing the security of your crypto transactions, [download our guide now](https://hibt.com/resources)!