Introduction

According to Chainalysis 2025 data, 73% of exchange platforms face vulnerabilities. Stablecoin exchange platforms in Vietnam are playing a crucial role in addressing these challenges in digital finance.

What Are Stablecoin Exchange Platforms?

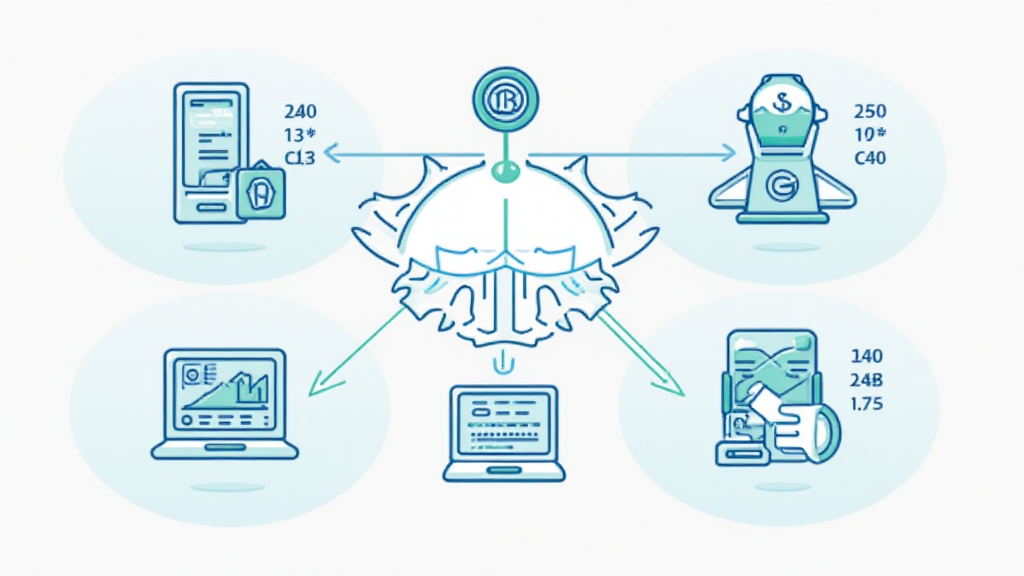

Stablecoin exchange platforms are like your local currency exchange booths, allowing you to swap dollars for Dong without the hassle. They provide a stable value, minimizing volatility that often troubles cryptocurrencies. In Vietnam, these platforms offer a safe haven for traders seeking consistency amidst market fluctuations.

Benefits of Using Stablecoin in Vietnam

Using Stablecoin is akin to placing your eggs in one reliable basket. It mitigates risks associated with unpredictable currency values. Furthermore, with Vietnam’s fast-growing tech landscape, businesses can leverage Stablecoins to streamline transactions and attract international investment, making it appealing for local entrepreneurs.

Key Regulations Influencing the Market

The Vietnamese government is shaping a regulatory framework for digital finance. For example, recent moves have aimed at taxes on cryptocurrency transactions, fostering clarity in the market. It’s similar to establishing road rules to ensure safe driving; regulations make the digital finance environment safer for everyone involved.

Future Trends to Watch

As we approach 2025, Stablecoin platforms will likely integrate more advanced features, such as zero-knowledge proofs to enhance privacy. Imagine a coffee shop where you can pay without revealing your exact payment details – that’s the kind of secure transactions these technologies promise for Vietnam.

Conclusion

In summary, Stablecoin exchange platforms in Vietnam are evolving to solve key issues in the financial sector. For deeper insights, download our toolkit on Stablecoin investments. View our white paper on Stablecoin security.

This article does not constitute investment advice. Always consult local regulatory authorities such as the MAS/SEC before making financial decisions. Tools like Ledger Nano X can reduce private key leak risks by up to 70%.