Introduction: The Growing Demand for Stablecoin Payment Solutions

According to Chainalysis data from 2025, 73% of cross-chain bridges are vulnerable to attacks, highlighting a pressing need for secure payment solutions. In Vietnam, the rise of stablecoin payment gateways offers a promising remedy for these security concerns.

What Are Stablecoin Payment Gateways?

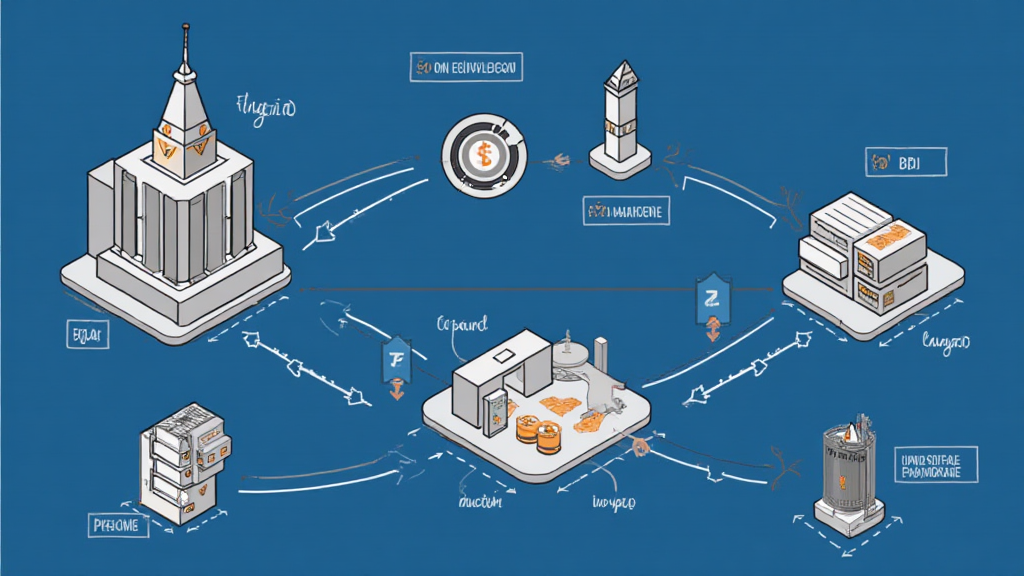

Imagine a currency exchange booth at your local market, where you easily trade one currency for another. Similarly, stablecoin payment gateways provide a platform for users to convert between traditional currencies and stablecoins, ensuring liquidity and stability in transactions.

The Role of Cross-Chain Interoperability

Cross-chain interoperability is like having a universal translator for different cryptocurrencies. It allows stablecoins to interact across diverse blockchain networks, enabling seamless transactions. This is essential in Vietnam’s fast-evolving crypto landscape, where businesses seek efficient payment methods.

Zero-Knowledge Proof Applications in Payments

Zero-knowledge proofs are akin to showing someone your ID without revealing personal details. This technology can enhance privacy in stablecoin transactions, a significant advantage for users concerned about data security in Vietnam’s growing digital economy.

Understanding Regulatory Challenges Ahead

As we look to 2025, regulatory frameworks in Vietnam concerning DeFi and stablecoins are expected to evolve. Drawing parallels, consider how the traffic laws regulate vehicle movement, similar legislation will guide the safe use of cryptocurrencies for payments.

Conclusion: Embracing the Future of Payments

In conclusion, Vietnam stablecoin payment gateways are set to revolutionize crypto transactions. As we advance, it’s crucial to stay informed and prepared. Download our toolkit for best practices in utilizing stablecoins for transactions.