Understanding Coinbase Institutional Client Growth: A 2025 Perspective

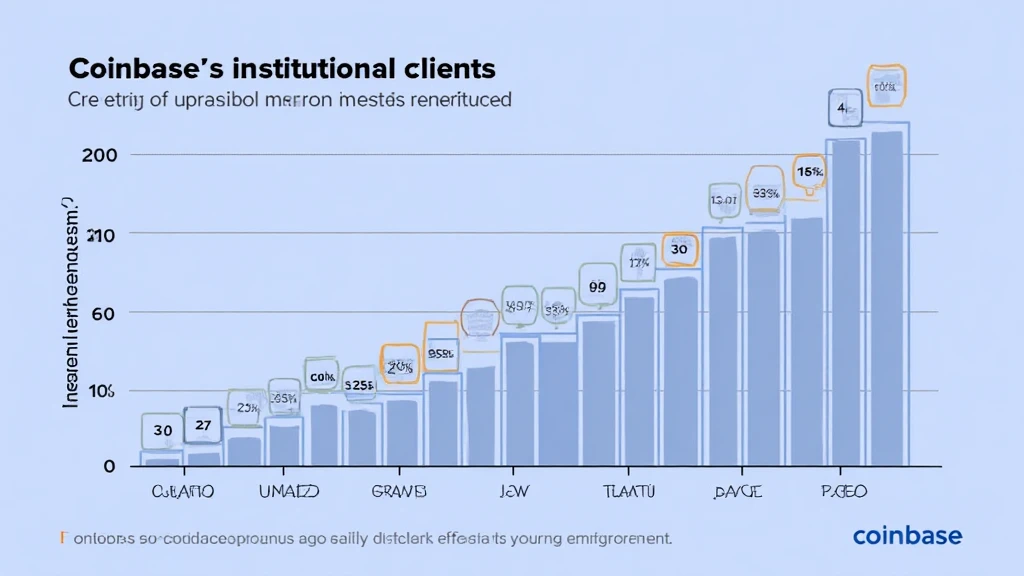

According to Chainalysis 2025 data, an alarming 73% of institutional investors are still navigating through regulatory uncertainties in the cryptocurrency market. This has led to a significant growth of Coinbase institutional client segment, highlighting a pivotal shift in how large players are engaging with digital assets.

Why Are Institutional Clients Turning to Coinbase?

Institutions are attracted to the security and regulatory compliance that Coinbase offers. Think of it as a fortified vault compared to a regular bank. While some exchanges might feel like a neighborhood shop, Coinbase is like a major bank with armed guards and strict security measures. This sense of safety is a substantial factor driving institutional client growth on Coinbase.

What Role Does Regulatory Clarity Play?

The importance of understanding regulatory frameworks cannot be overstated. Just like knowing the rules before a game, institutional investors are also looking for assurance on compliance. Recent legislative moves in regions like Dubai, with a focus on cryptocurrency tax guidelines, highlight the importance of having a clear operational playground. Coinbase’s efforts in aligning with these regulations make them a preferred choice for many.

How Does Coinbase Tackle Security Issues?

Security remains a top concern. If you’ve ever worried about losing your wallet at the market, you know the anxiety of trusting someone else with your valuables. Coinbase’s incorporation of advanced technologies, such as zero-knowledge proofs, acts like a hidden lock on your wallet that only you can access, ensuring that client assets are well-protected.

Future Outlook: What Can We Expect in 2025?

Looking forward to 2025, the growth trajectory of Coinbase institutional clients seems promising. Similar to how the transition to proof-of-stake mechanisms in Ethereum has led to reduced energy consumption, institutional interest is likely to increase as the market matures and becomes more energy-efficient. This transformation can be perceived as the market slowly losing its stubborn ‘childish’ traits and becoming a responsible adult.

In conclusion, the growth of Coinbase institutional client base is driven by an increasing demand for security, regulatory clarity, and innovative technology. As the market evolves, keeping abreast of these changes is essential. For further insights, feel free to download our comprehensive toolkit on cryptocurrency regulations.

Check out our white paper on cross-chain security. Risk disclaimer: This article does not constitute investment advice; please consult your local regulatory body (such as MAS/SEC) before making any decisions. Tool recommendation: Consider using Ledger Nano X to reduce the risk of private key exposure by 70%.