Understanding the Current State of Vietnam’s Government Bonds

According to Chainalysis 2025 data, Vietnam’s government bonds are increasingly integrated with digital infrastructure, offering a new level of security and efficiency for local and foreign investors. Currently, many investors face challenges in tracking the performance and compliance of these government bonds due to outdated systems. Think of it like trying to find a specific stall in a huge market without proper signage. This lack of clarity can deter investors who are looking for secure investment options.

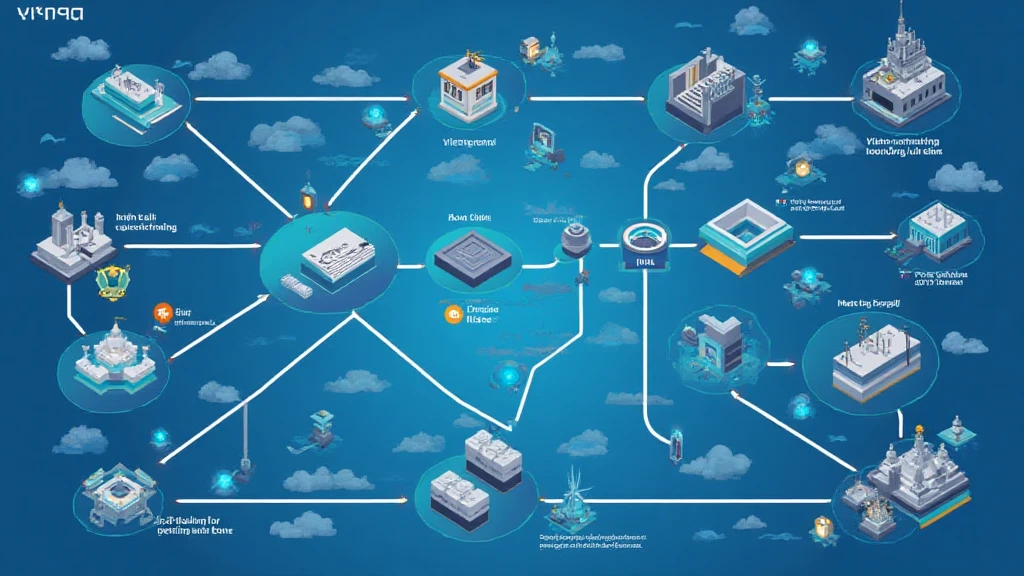

The Role of Digital Infrastructure in Enhancing Bond Security

Digital infrastructure acts as the backbone for modern financial systems, much like a well-designed road network facilitates smooth traffic flow. With the integration of technologies like blockchain, Vietnam is not only enhancing the security of government bonds but also ensuring safe and transparent transactions. A 2025 report from CoinGecko highlights that regions utilizing advanced digital infrastructure see a significant decrease in fraud cases, making them more attractive for investments.

The Importance of Cross-Chain Interoperability

Cross-chain interoperability is akin to having a universal plug that connects all your appliances regardless of the brand. In Vietnam, the incorporation of cross-chain technology means that investment opportunities can flow seamlessly between different platforms. This enhances liquidity and allows for real-time updates on bond performance, greatly benefitting investors. Implementing zero-knowledge proof applications can enhance privacy, giving investors peace of mind regarding their financial information.

What Investors Should Consider Moving Forward

As investors consider Vietnamese government bonds integrated with digital infrastructure, they should keep a close eye on market trends. A 2025 perspective could point towards more regulations and a shift in interest rates that may impact bond valuations. It’s important to think of this investment as you would a garden: it requires regular monitoring and nurturing to bloom fully. Utilizing tools like Ledger Nano X can reduce the risk of private key exposure by up to 70%, making investments much safer.

Conclusion and Call to Action

In summary, Vietnam’s evolution towards a digital infrastructure for government bonds promises to enhance security and investor confidence. For those interested in exploring this landscape further, we invite you to download our toolkit on safe investing strategies and enhance your knowledge base. Remember to stay informed and consult local regulatory bodies before making any significant investment decisions.