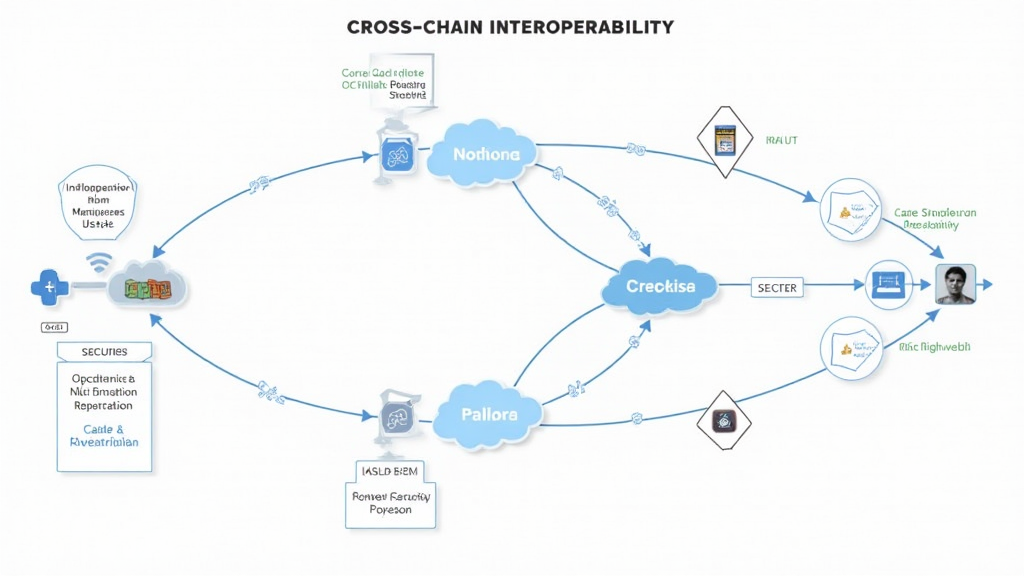

Understanding Cross-Chain Bridges: The Basics

Imagine you’re at a currency exchange booth while traveling abroad. You want to exchange your dollars for euros, but the exchange rate can vary, and fees can apply. This is similar to how cross-chain bridges work in the cryptocurrency world. These bridges allow different blockchain networks to communicate and transfer assets seamlessly. However, just like the currency booths, many of these bridges are under scrutiny for security vulnerabilities. According to Chainalysis 2025 data, an alarming 73% of cross-chain bridges have been found to have security loopholes.

Risks Associated with Cross-Chain Bridges

So, what makes these bridges risky? Think of it this way: if you don’t trust the currency exchange booth you’re using, you might lose money. Similarly, poorly audited cross-chain bridges can lead to significant losses for traders. Users must understand the infrastructure of these bridges, as they are often a target for hackers looking to exploit weaknesses. Conducting thorough research can mitigate some of these risks. In countries like Vietnam, where digital finance is rapidly evolving, regulatory frameworks and financial intelligence must keep pace to protect users.

The Role of Zero-Knowledge Proofs in Security

When it comes to enhancing security, zero-knowledge proofs play a pivotal role. Consider them a way to prove you have funds without revealing the actual amount—like showing your ID without giving away your birthdate. This technology ensures that data remains private while transactions are verified, making it harder for fraudsters to glean sensitive information. Vietnam’s growing fintech sector can significantly benefit from implementing these solutions, furthering the integrity of their financial systems.

Future Trends: What to Watch in 2025

Looking ahead to 2025, it’s essential to stay aware of the evolving regulatory landscape in places like Singapore concerning DeFi. The government’s increasing focus on compliance will influence how projects operate, aiming to minimize risks associated with cross-chain transactions. Moreover, the energy consumption debate surrounding Proof of Stake (PoS) mechanisms will continue to shape the conversation around sustainable cryptocurrency solutions.

Conclusion and Call to Action

As we explore these advancements and trends, it’s crucial for individuals and organizations to stay informed and vigilant. To delve deeper into the security of cross-chain bridges and the implications on Vietnam financial intelligence, download our comprehensive toolkit today. Equip yourself with knowledge and tools to navigate the complex world of cryptocurrencies safely.