Decentralized Exchanges DEX Review: 2025 Trends in cross/”>Cross-Chain Interoperability

According to Chainalysis data from 2025, a whopping 73% of cross-chain bridges have vulnerabilities. This alarming statistic highlights the urgent need for better security measures in decentralized exchanges (DEX). Decentralized technologies are shaping the future of finance, and understanding their intricacies is critical for users and investors alike.

1. What Are Decentralized Exchanges?

Think of decentralized exchanges as the digital equivalent of a community market where people can trade without a middleman. Unlike traditional exchanges, DEX allows users to retain control of their assets, leading to a more secure trading experience. Using cryptocurrencies like Bitcoin or Ethereum, users can swap tokens directly from their wallets, thus eliminating custodial risks.

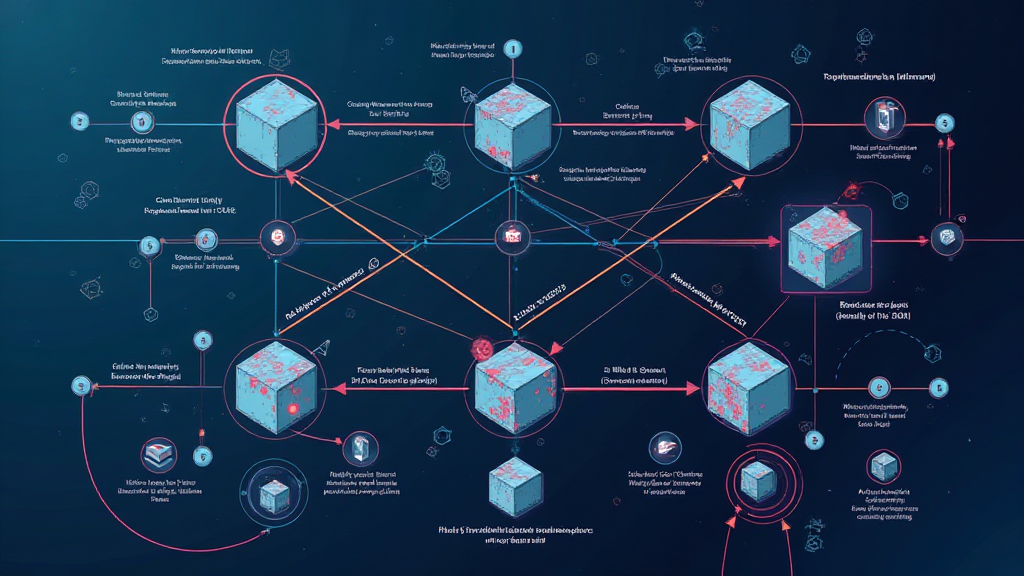

2. How Do cross/”>Cross-Chain Bridges Work?

Imagine a currency exchange booth at an airport—this is essentially what a cross-chain bridge does. It allows users to transfer assets between different blockchains. This functionality is crucial for the growth of the DeFi (Decentralized Finance) ecosystem, especially as we approach 2025, where regulatory frameworks are bound to evolve, particularly in regions like Singapore.

3. The Role of Zero-Knowledge Proofs in DEX

In simple terms, zero-knowledge proofs are like having a secret recipe that you can share without revealing the ingredients. These cryptographic techniques enhance privacy and security in transactions, making them integral to the next wave of decentralized exchanges. With ongoing developments, expect to see more projects adopting this technology to secure user identities and transactions.

4. Energy Consumption Comparisons of Proof-of-Stake Mechanisms

As sustainability becomes a global focus, comparing the energy consumption of different consensus mechanisms, such as Proof-of-Stake (PoS), is crucial. PoS drastically reduces energy consumption compared to Proof-of-Work (PoW) systems—imagine switching from a gas-guzzling car to an electric vehicle. This shift not only helps the environment but also enhances the appeal of DEX in eco-conscious markets.

In conclusion, as we head towards 2025, understanding decentralized exchanges and their role in the financial ecosystem is paramount. For more insights and a comprehensive toolkit on using DEX safely, visit hibt.com. Whether you’re an experienced trader or a newcomer, empowering yourself with knowledge is the best move.

Risk Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always consult local regulatory bodies such as MAS or SEC before making any financial decisions.

Explore more to enhance your trading experience. Download our comprehensive toolkit today!