2025 cross/”>Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges are vulnerable. This alarming statistic highlights a significant pain point in crypto trading strategies today. Without effective security measures, traders could easily fall victim to exploits, dramatically affecting their portfolios. Here we explore actionable insights to enhance the security of cross-chain interactions.

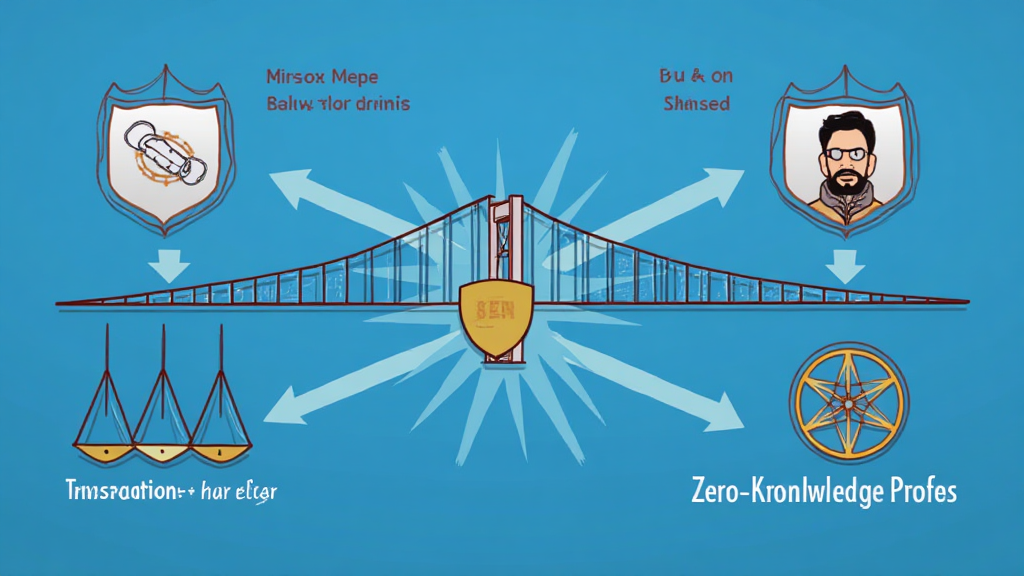

Understanding cross/”>Cross-Chain Bridges

Think of cross-chain bridges like currency exchange booths at an airport. Just like you’d swap your dollars for euros before your European vacation, cross-chain bridges facilitate the exchange of assets between different blockchain networks. However, with 73% of these bridges showing vulnerabilities, the need to adopt robust crypto trading strategies has never been clearer.

Identifying Vulnerabilities

Catching a cold safe is like identifying potential vulnerabilities in cross-chain transactions. Just as a doctor checks for symptoms, traders must conduct thorough audits of their trading tools. Tools such as smart contract code audits can reveal flaws in the system before they are exploited. Investing in these audits is a prudent crypto trading strategy for those serious about secure trading.

Implementing Security Measures

Implementing zero-knowledge proof applications can significantly reduce risks. Imagine being able to prove you have a secret without revealing the secret itself; that’s what zero-knowledge proofs do. They add an extra layer of security, crucial for your crypto trading strategies when transacting across different chains.

Future Regulations in DeFi

As we look ahead to 2025, understanding the regulatory landscape in places like Singapore is essential. Regulations will shape how traders can operate safely and legally in DeFi markets. Them knowing the 2025 Singapore DeFi regulatory trends can save you from potential pitfalls. Therefore, incorporating this knowledge into your trading strategies is a smart move.

In conclusion, it’s vital to acknowledge the risks associated with cross-chain trading. By implementing robust security measures, understanding future regulatory environments, and utilizing innovative technologies like zero-knowledge proofs, you can enhance your crypto trading strategies. To stay ahead and protect your investments, consider downloading our Crypto Security Toolkit today!

Check out our cross-chain security white paper and learn more about minimizing risks in your crypto ventures.

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authorities before making financial decisions.

Tools: Consider using Ledger Nano X to reduce the risk of private key leaks by as much as 70%!

Author: Dr. Elena Thorne

Former IMF blockchain advisor | ISO/TC 307 standards developer | Published 17 IEEE blockchain papers