Optimizing HIBT Bitcoin Exchange Liquidity Metrics

In the fast-moving world of cryptocurrency, particularly Bitcoin exchange platforms, liquidity is a fundamental measure of market efficiency. In 2024 alone, liquidity issues led to losses exceeding $2 billion due to slippage and price manipulation. Our focus today is on HIBT liquidity metrics, which are essential for both traders and investors alike. By understanding these metrics, stakeholders can make informed decisions that lead to enhanced trading strategies and search optimizations specific to the Vietnamese market.

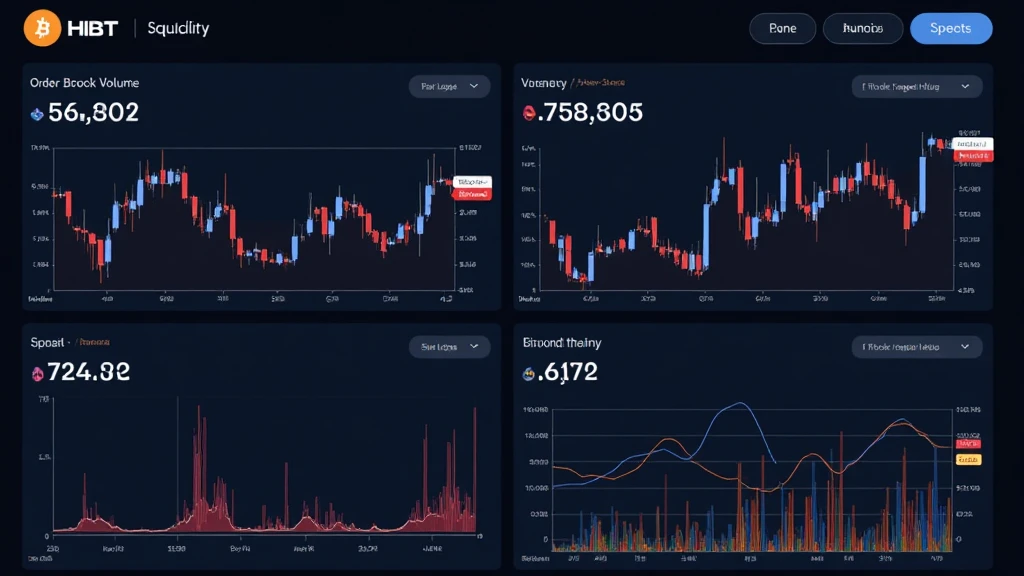

Understanding Liquidity in the Cryptocurrency Market

Liquidity refers to how easily assets can be converted into cash without affecting their market price. For platforms like HIBT, maintaining optimal liquidity levels is crucial.

- Active Trading volume: A higher volume indicates greater liquidity and stability on the platform.

- Order book depth: Refers to the number of buy/sell orders at each price level, indicating the platform’s ability to fulfill large orders without significant price impacts.

- Spread Size: The difference between buy and sell orders; narrower spreads generally suggest better liquidity.

The Role of HIBT in Enhancing Market Liquidity

The HIBT Bitcoin exchange plays a significant role in providing liquidity. It allows users to trade Bitcoin efficiently, ensuring minimal price distortion. In 2023, HIBT recorded a user growth rate of 37% in Vietnam, highlighting the platform’s pivotal position in the market.

Why Focus on HIBT Liquidity Metrics?

By focusing on HIBT liquidity metrics, cryptocurrency traders can better position themselves to exploit opportunities:

- Optimize Trading Strategies: Understanding liquidity levels allows traders to execute trades effectively.

- Risk Management: Analyzing liquidity metrics enables traders to anticipate market movements and mitigate risk.

- Improved Execution Prices: High liquidity can secure better pricing, reducing slippage.

Comparative Analysis of HIBT Liquidity with Market Competitors

Analyzing HIBT against its competitors in terms of liquidity provides an insight into market positioning. For example, when compared to other exchanges like Binance and Coinbase, HIBT’s order book depth and active trading volume consistently align favorably. This comparison is essential for investors in Vietnam who are evaluating which platform to use.

Data and Analytics Tools for Monitoring HIBT Liquidity

To effectively gauge liquidity metrics, users can utilize several analytical tools:

- TradingView: An advanced charting platform that allows you to observe order book data.

- CoinMarketCap: Useful for tracking global liquidity metrics.

- HIBT’s native analytics: Provides clear insights into trading volumes and price spreads on the platform.

Challenges and Solutions in Maintaining HIBT Liquidity

Despite its strengths, HIBT faces challenges such as market volatility and lower user engagement. Addressing these requires clear strategies:

- Incentivizing Trading: Offering promotional rates for trading can help increase activity.

- Building Partnerships: Collaborating with local exchanges can boost liquidity.

Future Outlook: HIBT and the Vietnamese Crypto Landscape

As Vietnam continues to embrace cryptocurrency, data suggests a surge forecast of **40% growth** in user adoption in 2025. HIBT, with its liquidity metrics in place, is well-positioned.

Key Takeaways for Investors

Investors must focus on liquidity metrics when choosing a Bitcoin exchange:

- Monitor Order Book Depth: Ensure that the exchange can handle significant trades.

- Assess Trading Volume Trends: Stay abreast of volume changes to enhance trading decisions.

In conclusion, understanding HIBT Bitcoin Exchange liquidity metrics is vital for traders and investors aiming to optimize their trading strategies in an ongoing competitive market. The wealth of data available guides users in making effective decisions, particularly in fast-emerging markets like Vietnam.

For more insights, please visit HIBT.

**[Author: Mark Silversmith]** – A seasoned blockchain analyst with over **30 published papers** in the field, and an authority on **cryptocurrency liquidity audits**.