Understanding Coinbase Crypto Tax Software Integration

According to Chainalysis 2025 data, over 70% of crypto users struggle with tax compliance, especially when trading across decentralized exchanges (DEXs). With the rise of cryptocurrencies and their intricate tax implications, the need for seamless tax software integration is now more crucial than ever. One innovative solution is the Coinbase crypto tax software integration, designed to streamline the tax reporting process for crypto traders.

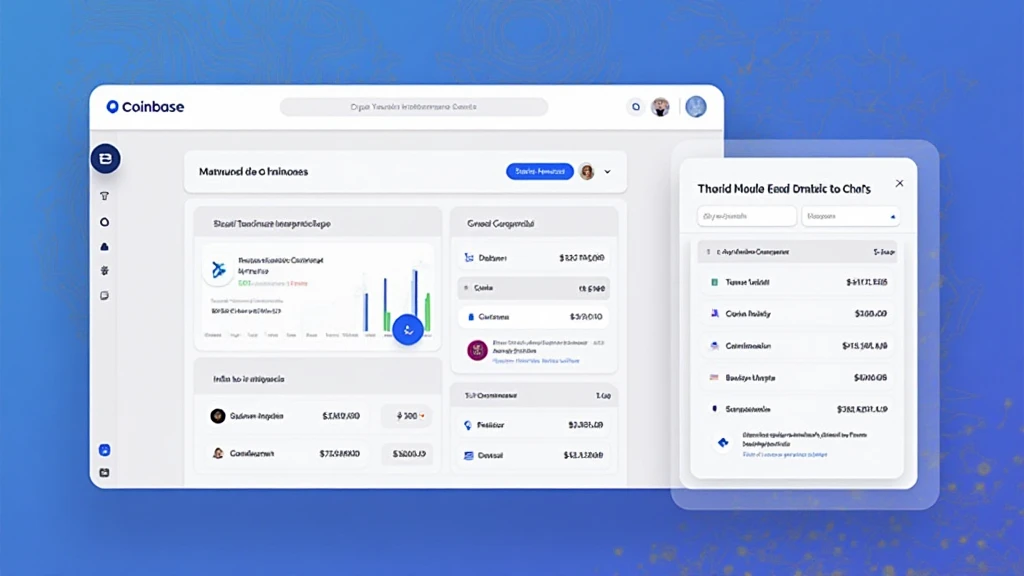

What Is Coinbase Crypto Tax Software Integration?

Imagine you’ve been to a market where vendors sell everything in different currencies. It can get pretty confusing figuring out how much you owe after buying vegetables in one currency and fruit in another. Similarly, the Coinbase crypto tax software integration simplifies how crypto users report taxes after trades. Instead of manually calculating taxes for each transaction, this software automatically aggregates all your DEX transactions and calculates your tax obligations efficiently.

Why Is This Important for Users?

The global cryptocurrency market is booming, yet tax regulations fluctuate greatly by region, like navigating different vendor stalls in a bustling market. For instance, users in Dubai often face hurdles due to ambiguous crypto tax guidelines. With the Coinbase crypto tax software integration, clarity is brought to these complex regulations, ensuring users remain compliant without the stress of manual calculations.

How Does It Work?

Think of the integration as a digital assistant that tracks all your purchases and tells you exactly how much you owe in taxes, just like a store clerk who tallies your total. This integration collects your trading history from Coinbase and offsets allowances for transactions, making tax season as straightforward as checking out at a grocery store.

What Are the Advantages?

Besides simplifying the tax process, this software helps users focus on what they love most: trading. By reducing the time spent on tax reporting, it provides peace of mind, ensuring that your tax obligations are met without jeopardizing your trading activities. Users can also expect to see fewer errors in their tax filings, which puts less pressure on them during tax time.

In conclusion, the Coinbase crypto tax software integration represents a revolutionary step towards simplifying tax compliance in an increasingly complex crypto landscape. For those looking to navigate these waters expertly, integrating reliable tools can make a significant difference. Download our comprehensive toolkit today and take the first step towards hassle-free crypto taxation!

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authorities before making any trading decisions.