Understanding Cryptocurrency Bond Collateral Frameworks for 2025

According to Chainalysis data from 2025, a staggering 73% of cryptocurrency bond collateral frameworks still face vulnerabilities. As the DeFi sector continues to mature, understanding these frameworks is crucial for investors and regulators alike. In this article, we will explore critical strategies and trends shaping the future of cryptocurrency bonds.

What are Cryptocurrency Bond Collateral Frameworks?

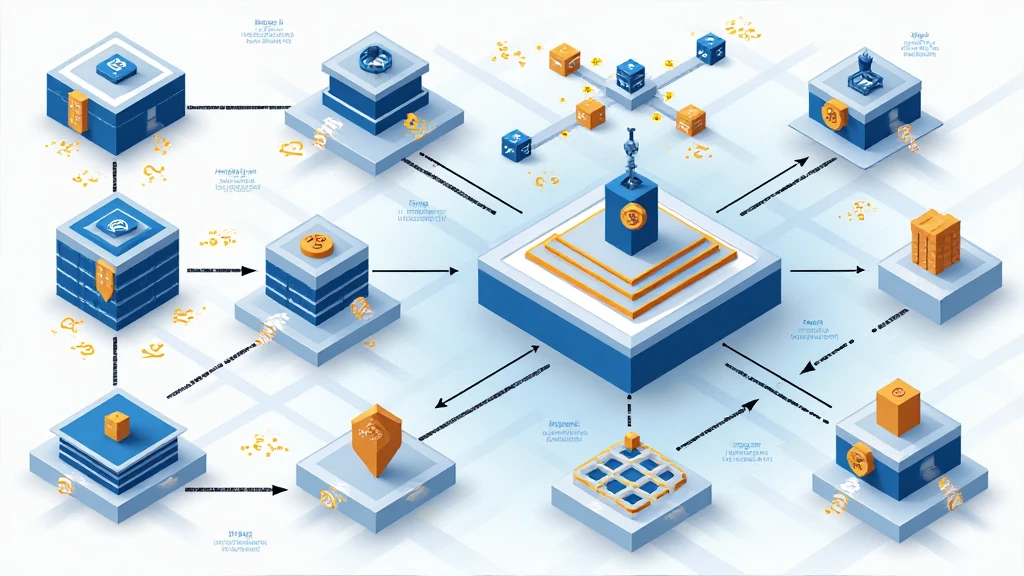

Think of cryptocurrency bond collateral frameworks like a marketplace for trading bonds, but instead of paper, we’re dealing with digital assets. They provide the assurance that bonds are backed by liquid cryptocurrencies, just like a secure storage facility backs every jewel displayed in a jewelry shop. This ensures investors feel safe putting their money into these ventures, while also laying the groundwork for future innovations.

Cross-Chain Interoperability: Bridging the Gap

You might have experienced standing in line at a currency exchange booth, waiting to change your dollars into euros. Cross-chain interoperability does the same for digital assets, allowing smooth transactions between different blockchain networks. For instance, it augments the versatility of collateral use in various markets and improves liquidity across platforms. As 2025 approaches, expect significant advancements here.

The Role of Zero-Knowledge Proofs in Security

Zero-knowledge proofs are comparable to a secret handshake in a club – you can prove you’re a member without revealing your identity. In cryptocurrency bond collateral frameworks, this technology plays a pivotal role in ensuring transaction confidentiality and enhancing security. Investors will feel more secure knowing their identity and holdings remain private, further legitimizing the use of cryptocurrencies in collateralized lending.

DeFi Regulations in Singapore: What to Expect?

With local regulations tightening, many wonder what the landscape will look like for 2025 in Singapore’s DeFi ecosystem. The upcoming regulatory changes will shape how collateralized bonds operate. Investors will need to stay informed about new compliance requirements that may emerge, ensuring their digital assets are always in line with local laws, such as those outlined by the Monetary Authority of Singapore (MAS).

In summary, as we head into 2025, understanding cryptocurrency bond collateral frameworks is vital for investors, developers, and regulators. The synergy of cross-chain interoperability, zero-knowledge proofs, and evolving regulations will help create a more secure and efficient market.

Download our comprehensive toolkit on cryptocurrency bond collateral frameworks to stay ahead of the curve.