A Comprehensive HIBT Bitcoin Leverage Trading Guide

\n

With $4.1 billion lost to DeFi hacks in 2024, understanding the world of cryptocurrency trading has never been more crucial. As the market expands, so do the opportunities and risks associated with trading, particularly in leveraging Bitcoin through platforms like HIBT. In this guide, we will explore the nuances of Bitcoin leverage trading, providing you with insights that can help you navigate this dynamic landscape effectively.

\n

What Is Bitcoin Leverage Trading?

\n

Leverage trading allows traders to borrow funds to increase their position size, potentially amplifying both profits and losses. For example, if a trader uses 10x leverage, for every dollar they invest, they can control $10 worth of Bitcoin. This can lead to significant gains if the market moves in their favor. However, it can also lead to equally significant losses if the market moves against them.

\n

Understanding the Risks Involved

\n

- \n

- Liquidation Risk: When using leverage, if the market moves against your position by a certain percentage, your position can be liquidated, leading to a total loss of your invested capital.

- Market Volatility: Cryptocurrency markets are notoriously volatile. This volatility can be amplified in leveraged positions.

- Interest Costs: Borrowing funds incurs interest, which can eat into profits over time.

\n

\n

\n

\n

How to Start Trading Bitcoin on HIBT

\n

Beginning your trading journey on HIBT requires several critical steps. Understanding these can streamline your trading process and improve your initial experiences.

\n

\n

Step 1: Creating an Account

\n

Visit the HIBT website to register for an account. Ensure you provide accurate personal information, as this verifies your identity and secures your account.

\n

Step 2: Funding Your Account

\n

Once your account is set up, deposit funds. You can fund your account with various payment methods, including bank transfers and cryptocurrency.

\n

Step 3: Learning the Platform

\n

Familiarize yourself with HIBT’s interface. Understanding how to navigate through the trading options, leverage sliders, and other functionalities of the platform is crucial.

\n

Strategies for Successful Leverage Trading

\n

Engaging in leverage trading warrants a solid strategy. Here are some effective techniques that can guide your trading journey.

\n

1. Risk Management

\n

- \n

- Set stop-loss orders: Protect your investment by automatically selling your position at a predetermined price.

- Only leverage what you can afford to lose: A good rule of thumb is to limit your leveraged trades to no more than 10% of your total investment capital.

\n

\n

\n

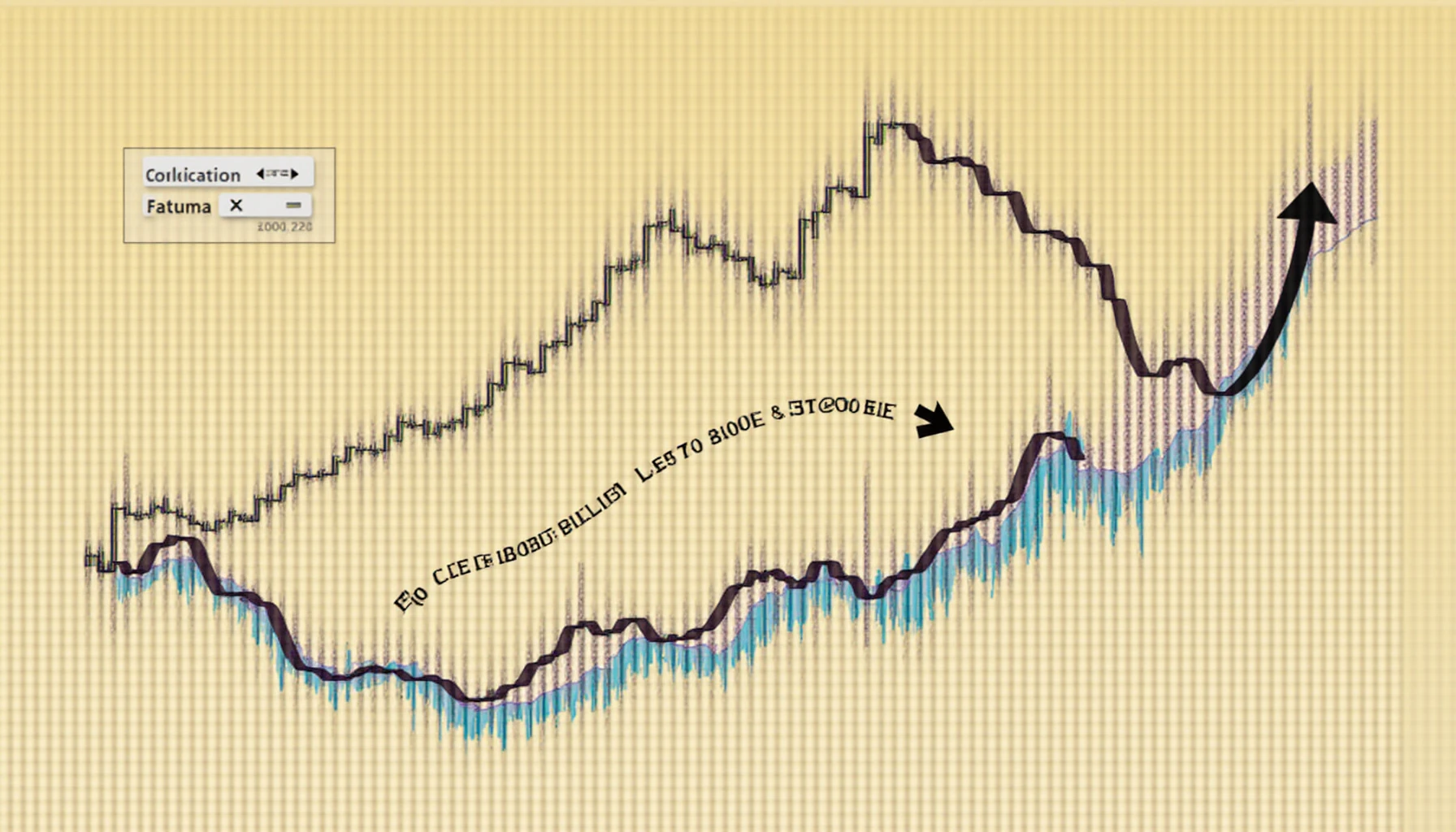

2. Technical Analysis

\n

Understanding charts and market indicators is vital. Invest time in learning tools like RSI and MACD, which can help you determine entry and exit points.

\n

3. Fundamentals of Cryptocurrency

\n

Keep abreast of the latest news and market trends. For example, if Bitcoin is expected to undergo a halving event, this could significantly impact its price.

\n

Vietnam’s Cryptocurrency Landscape

\n

In recent years, the cryptocurrency market has seen significant growth in Vietnam. According to recent surveys, 41% of Vietnamese internet users are interested in cryptocurrency investment. This reflects a vibrant community eager to explore opportunities like Bitcoin leverage trading.

\n

Trends Among Vietnamese Traders

\n

- \n

- The rise of localized exchanges.

- Increased educational resources tailored for Vietnamese users.

- Government interest in establishing regulatory frameworks.

\n

\n

\n

\n

Conclusion: Navigating the Future of Bitcoin Trading

\n

As the cryptocurrency market evolves, traders must equip themselves with the knowledge needed to trade effectively. Leveraging Bitcoin through HIBT can offer tremendous opportunities, but it also demands a cautious approach. Always remember the mantra of investing: Only invest what you can afford to lose.

\n

For more information on leverage trading and market strategies, visit HIBT and dive deeper into the insights available.

\n

About the Author: Dr. Alex Nguyen is a financial analyst specializing in cryptocurrencies with over 15 published papers on blockchain technology and smart contracts. He has led several high-profile blockchain audits, ensuring projects’ compliance and security.

\n