Introduction

In 2024, we witnessed a staggering $4.1 billion lost to DeFi hacking incidents, highlighting the pressing need for effective trading strategies in the volatile world of cryptocurrencies. One such strategy that traders must familiarize themselves with is the HIBT crypto order types. But what exactly are these order types, and how do they play a crucial role in securing your digital asset portfolio?

As more users enter the Vietnamese market, where crypto trading is on a steady rise (experiencing a growth rate of over 25% just last year), understanding these order types is key for both novice and experienced traders. This article will explore the different HIBT crypto order types, their benefits, and tips on their effective use.

What are HIBT Crypto Order Types?

HIBT (High-Impact Buy/Sell Types) crypto order types refer to advanced trading orders that allow users to execute trades at specific price levels and conditions, thereby optimizing their trading strategies. These orders go beyond standard market and limit orders, providing traders with nuanced control over their transactions.

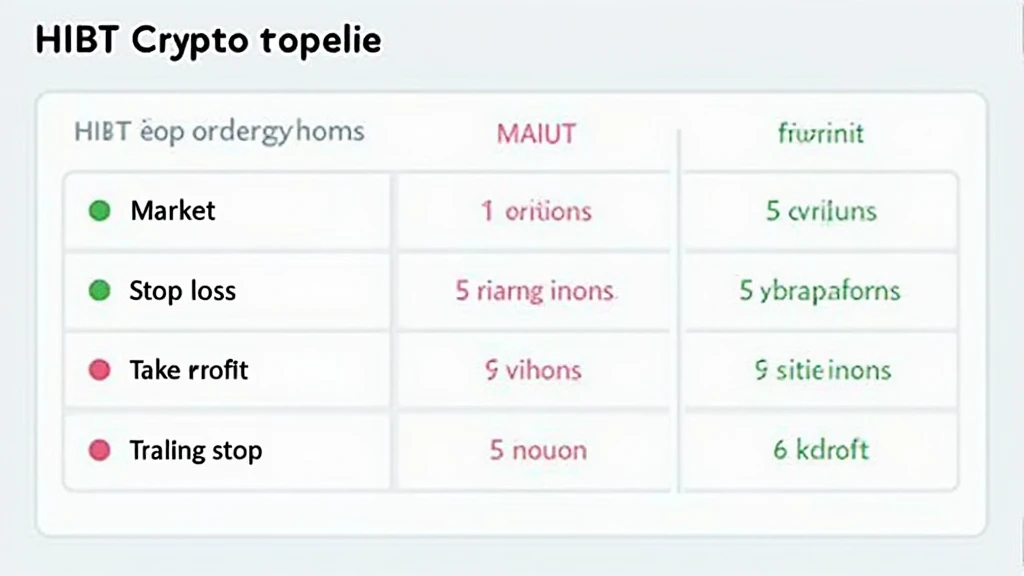

Here’s a breakdown of common order types you’ll likely encounter:

- Market Orders: Instantly execute a buy or sell at the current market price.

- Limit Orders: Set a specific price for buying or selling, waiting for the market to reach that price.

- Stop-Loss Orders: Automatically sell a crypto asset when it reaches a predetermined price to minimize losses.

- Take-Profit Orders: Secure profits by automatically selling when a specific price point is reached.

- Trailing Stop Orders: A dynamic stop-loss order that adjusts as the price of the crypto rises.

The flexibility in using these orders helps traders manage risk and maximize their profit potential.

Advantages of Using HIBT Orders

When it comes to trading cryptocurrencies, the advantages of employing HIBT crypto order types are numerous. Let’s break down the key benefits:

- Reduces Emotional Trading: By setting predefined criteria, traders can avoid impulsive decisions during market volatility.

- Increases Efficiency: Automated trading allows for faster execution compared to manual processes, especially beneficial in a rapidly changing crypto market.

- Better Risk Management: Stop-loss orders, for example, help to safeguard profits and limit losses.

- Strategic Flexibility: Traders can deploy different order types to suit various market conditions and personal risk tolerance.

Common Pitfalls to Avoid

Despite the advantages, there are common pitfalls associated with HIBT crypto order types. Here are a few to be aware of:

- Over-reliance on Automation: While automated orders can be beneficial, they can also lead to missed opportunities in fast-moving markets.

- Failure to Monitor Market Conditions: Always keep an eye on market movements, as conditions can change rapidly and affect the effectiveness of your orders.

- Setting Unrealistic Targets: Setting overly ambitious price points for limit or take-profit orders can result in missed trades.

- Neglecting Transaction Fees: Be mindful of fees associated with different order types; they can eat into profits.

Using HIBT Orders in the Vietnamese Market

As the Vietnamese crypto market continues to expand, with a user growth rate exceeding 25%, understanding how to effectively implement HIBT crypto order types becomes critical for local traders. With various exchanges facilitating crypto trading in Vietnam, utilizing strategies such as stop-loss and take-profit orders can help minimize risks.

For instance, Vietnamese traders can employ trailing stop orders to lock in profits as the market expands, providing a cushion against potential downturns. Such strategic applications align with the rise of DeFi applications native to the Vietnamese crypto landscape, emphasizing security and risk management.

Real Data Table: Volume of Trades in Vietnam

| Year | Volume of Trades (in USD) | Average User Growth Rate |

|---|---|---|

| 2022 | $1.5 billion | 20% |

| 2023 | $2.3 billion | 25% |

| 2024 | $3.6 billion | 30% |

Conclusion

Understanding HIBT crypto order types is crucial for achieving trading success in the rapidly evolving landscape of cryptocurrencies. From retail to institutional trading, these orders offer practical strategies to enhance transaction security and profitability.

As Vietnam’s crypto market continues to evolve, traders must stay informed on the various features of HIBT orders, applying them wisely while keeping in mind the market dynamics. Whether you’re a new trader or an experienced investor, mastering these orders can significantly augment your trading efficacy.

For more insights into cryptocurrency trading and investment, visit hibt.com. Be prepared to navigate the challenges ahead and secure your place in the thriving world of digital assets.

Author: Dr. Alexander Tran, a recognized expert in blockchain technology with several publications on crypto trading strategies and compliance regulations. He has also led audits on notable DeFi projects.