Addressing USDT Stability Concerns: The Future of Stablecoins in 2025

According to Chainanalysis, by 2025, a staggering 73% of stablecoins face potential instability due to various concerns. With USDT being the predominant player, understanding its stability issues is crucial for investors and regulators alike.

What Makes USDT Vulnerable?

Imagine a bustling market where vendors sell a variety of goods. Some vendors are trusted, but others are known to cut corners. Similarly, USDT, while stable, has faced scrutiny over its reserves. Many wonder whether it has adequate backing or if it could falter unexpectedly, affecting millions of users.

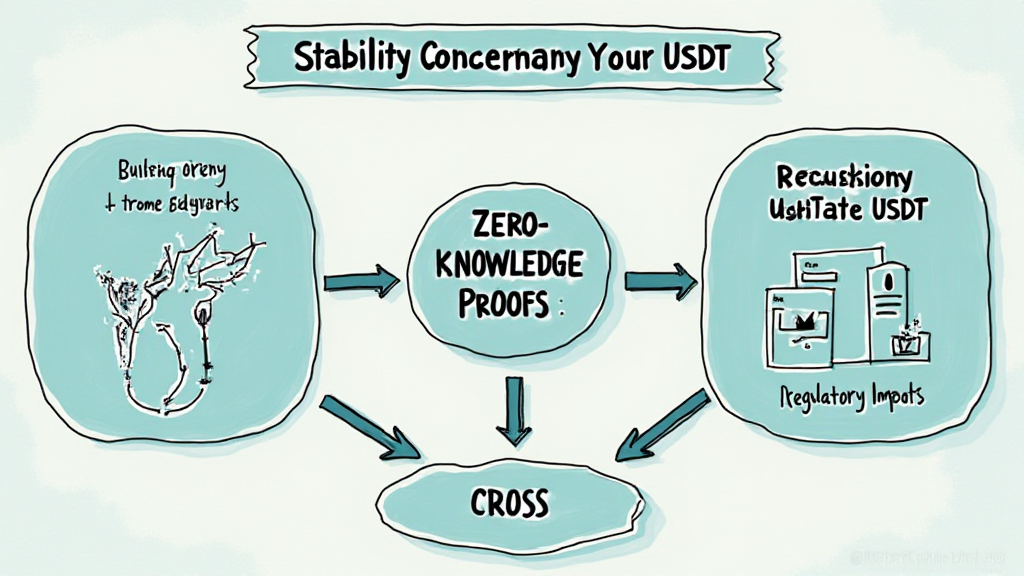

The Importance of cross/”>Cross-Chain Interoperability

Think of cross-chain interoperability like a currency exchange booth, allowing you to swap currencies seamlessly. For USDT to thrive, it must ensure that it can function across different blockchain platforms securely. If USDT struggles with interoperability, it risks losing user trust.

Zero-Knowledge Proof Applications in Stablecoins

Picture a vendor at the market who can prove their goods are organic without revealing their secret sauce. That’s what zero-knowledge proofs offer for USDT—enhanced privacy and security. This technology could address transparency issues, making users feel safer about the stability of their assets.

Local Regulatory Environments Shaping USDT’s Future

Regulations play a significant role in crypto stability. For instance, the developments in Dubai’s cryptocurrency tax regulations can directly impact how USDT operates in the region. A strict regulatory environment could either bolster trust or stifle innovation in the stablecoin arena.

In conclusion, understanding and addressing USDT’s stability concerns is vital for its future. As the landscape evolves toward 2025, users and regulators must keep a close watch on how technology and governance intertwine. For more insights and tools to navigate the evolving landscape, download our toolkit.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always consult local regulatory bodies before making investment decisions.