Vietnam Crypto Bond Portfolio Trackers: A 2025 Financial Trend

According to Chainalysis 2025 data, a staggering 73% of investments in digital bonds lack proper tracking mechanisms. This gap presents a significant challenge for investors venturing into the crypto space, particularly in markets like Vietnam where crypto bond portfolio trackers are emerging as potential solutions.

Understanding Crypto Bond Portfolio Trackers

Imagine you’re at a busy market, trying to manage your grocery list while keeping track of prices. This is similar to how investors manage their crypto portfolios using bond trackers. They help you visualize what you own, how much it costs, and how much you may earn. In Vietnam, these tools are becoming pivotal for ensuring that bonds in the crypto arena are adequately monitored and evaluated.

The Benefits of Using Trackers

You might have heard about the effects of market volatility. Think of it like a fruit seller’s price swings depending on the season. Crypto bond portfolio trackers provide real-time updates, helping investors react swiftly to avoid losses. They empower users to make informed decisions, capitalizing on price dips and surges.

Compliance and Regulation: A Key Aspect

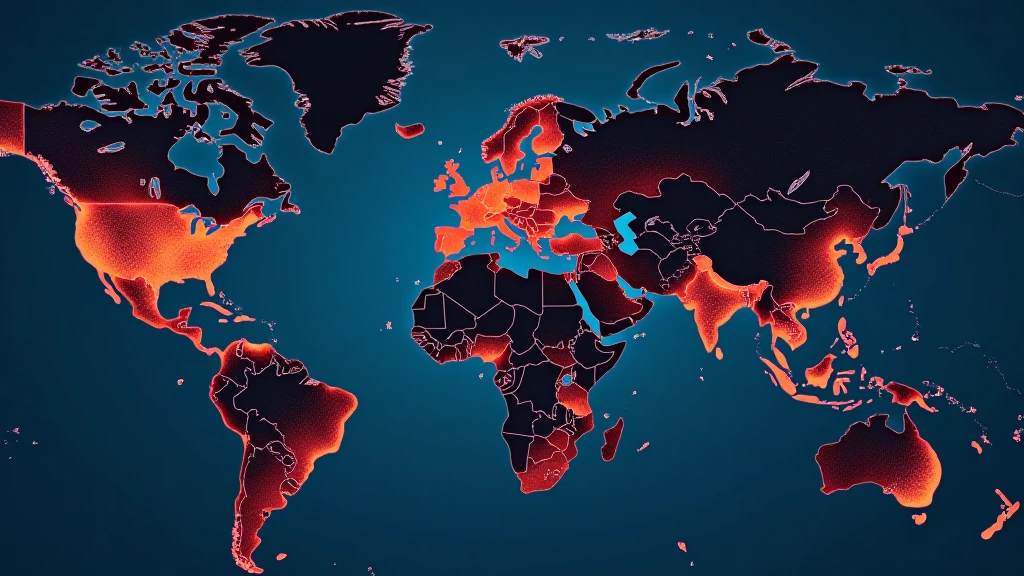

As the crypto landscape evolves, so do regulatory frameworks. For instance, similar to how you need a valid ID to buy alcohol, crypto investments are increasingly under scrutiny. 2025 predictions indicate stricter regulations for digital assets globally, affecting how investments, particularly in Vietnam, are reported and monitored through these portfolio trackers.

Emerging Technologies Enhancing Trackers

Ever tried smart technology that calculates your grocery budget? Crypto bond portfolio trackers employ advanced tech like cross-chain interoperability and zero-knowledge proofs, making tracking sophisticated yet user-friendly. This tech helps ensure that your investments remain secure and accessible, leveraging blockchain’s decentralized nature.

In conclusion, as Vietnam embraces crypto bond portfolio trackers, investors gain essential tools to navigate the complexities of digital assets. Understanding these tools is crucial for effective investment management in a dynamic financial landscape. Download our toolkit to enhance your investment strategies today!